Debt is political: Why wealth flows from poor to rich

How does the structure of the international financial system cause a drain of wealth from the poor to the rich? Political economists Radhika Desai and Michael Hudson discuss the politics of debt.

How does the structure of the international financial system cause a drain of wealth from the poor to the rich? Political economists Radhika Desai and Michael Hudson discuss the politics of debt.

You can find more episodes of Geopolitical Economy Hour here.

Video

Podcast

Transcript

RADHIKA DESAI: Hello and welcome to the 31st Geopolitical Economy Hour, the show that examines the fast-changing political and geopolitical economy of our time. I'm Radhika Desai.

MICHAEL HUDSON: And I'm Michael Hudson.

RADHIKA DESAI: And working behind the scenes to bring you our show every fortnight are our host, Ben Norton; our videographer, Paul Graham; and our transcriber, Zach Weisser.

You may think that today, given the events of recent weeks, we might be talking about the wars that seem set to spiral out of control, particularly with Israel appearing so determined to escalate its hostilities with Hezbollah that it is willing to make accusations on entirely and visibly flimsy grounds. You might think that we will talk about how it's not at all clear who's in control, particularly in that country that so often fancies itself as the world's policeman or woman, as the case may be. And indeed, we certainly intend to cover these topics in the future. However, today we will focus on a very closely related topic, and that is debt.

We're taught to think of debt as an ordinary or economic or market relationship, no different from the buying and selling of goods and services, which is done by two formally equal parties. Each gives something to another, and they're, roughly speaking, equal in value. So, equal is like is exchanged for like, and everything is fine.

However, we all know that even in the case of the exchange of goods and services, parties are not formally equal, and differences in power between them has enormous influence on the transaction. And if that is so, even in the case of the ordinary exchange of goods and services, it is even more so in the case of the debt-credit relationship.

Indeed, it should be thought of not so much as an economic or a market relationship, as a profoundly political one, more reliant on power than any other so-called economic relationship.

Who gets credit and who doesn't? Who gets favorable terms and who gets harsh terms? Who pays high interest and who pays low interest? Who gets bailed out when in default, and who is required to pay even more for the same problem?

These are the sorts of questions that hang around debt, and all of them show what a profoundly political relationship debt is.

And as Clausewitz says, war is just another way of doing politics, and war and debt are therefore also deeply connected.

Ever since London bankers convinced William III to borrow from them rather than to tax them to finance their wars back in 1694, wars have generated debt, massive debt, and the current wars are no exception.

Ukraine is effectively fighting a debt-fueled war, and whatever rump Ukrainian state remains after this war is over, and we expect it certainly cannot be before the 5th of November, is going to be saddled with unpayable levels of debt.

Meanwhile, markets have downgraded Israel's debt to practically junk status, and a similar fate will surely await Taiwan should its leaders be foolish enough to agree to be a US proxy against China.

And today there is another reason to talk about debt. The World Bank, as well as economists all over the world, and also the UNCTAD, the developing world's think tank, so to speak, have all been talking about a new third world debt crisis.

There was one, some of you may remember or know, back in the early 1980s. And indeed, since then, unsustainable debt has remained a major obstacle in the third world's development prospects.

From what we see, the genesis of the current third world debt crisis, or developing world's debt crisis, whatever euphemism you want to use, the debt crisis of the poor countries of the world, is very similar to that of the 1980s.

However, the outcomes may be quite different, and this is something we can discuss. Michael and I will at least speculate about that.

And finally, when we talk about public debt or sovereign debt, we have to talk about the IMF and the World Bank, the bailiffs of Western financial capital. When they shed crocodile tears about the welfare losses caused by debt repayment, which divert money away from health care or education or clean water in the developing world, they do that on the one hand. And on the other hand, they impose the most draconian repayment terms, ensuring massive reverse capital flows, that is to say, capital flowing not from rich country to poor countries, as it's supposed to do in economics textbooks, but on the contrary, from poor countries to rich countries.

At the same time, they demonstrate the tenderest of mercies for the debt of friendly countries like Ukraine. It is no wonder that there is another campaign marking the 80th anniversary of these two vampire institutions calling for their abolition.

The only good news is that they are becoming less and less effective and less and less important, chiefly because of the rise of China as a major creditor.

So this is the background to what we are going to talk about today. And Michael, you've done an enormous amount of work. I know you've been following the debt of Ukraine going back to 2014, if not earlier. So why don't you start us off by talking about the debt of Ukraine and how the IMF has been dealing with it?

MICHAEL HUDSON: The current Ukrainian debt tangle shows what a double standard there is for the IMF, and in fact, the whole international bond community, when it comes to treating countries that can't pay their debt and are in similar debt straits.

Two years ago, when the fighting with Russia began, when Russia had to intervene because the Russian-speaking areas of Ukraine were under civilian attack, it was obvious that Ukraine wouldn't pay the debt. So the international bondholders that had debt falling due then said, okay, you don't have to pay us now. We know that you're at war. Let's put it off for two years, and let's wait until August 1, 2024.

That's exactly where we are now. Two years ago, they said the war will certainly be over by then. The IMF and the United States said Ukraine is going to beat Russia, and for all we know, we'll march into Russia, but there won't be a war. Ukraine can pay back then. So everybody said, okay, wait, you'll just keep accruing interest to us.

You can imagine what happened a month ago as the payment time came due. What was Ukraine going to do? And obviously, Ukraine didn't have the money, and the bondholders had a choice. Either they could insist on being paid and say, you're in default, we're going to list you in default, and if you can't pay us, that means that the IMF, according to its rules, which it doesn't follow, but according to the rules, if people did follow them, that it's not permitted to lend to countries that are in default against private creditors.

That's because the IMF is a policeman acting as a lobbyist for the private creditors, forcing bonds to be paid.

And so the leading bondholders, we're talking about people, the biggest bond funds, PIMCO bond fund, Blackstone got together, and they had a choice. What they did was something very remarkable. They actually said, okay, Ukraine, not only do you not have to pay the debt that's falling due now, but you can write down the debt by about 39% because we know that you can't pay. Just promise to pay us beginning in a few years more from now when we know that you will have defeated Russia and can afford to pay. And they actually took a very large loss on what had become Ukrainian junk bonds.

What surprised me is this is not what normal international bankers did. It was open to them to say, no, we're going to foreclose, and they would have understood that the US government and the IMF would have done everything they could to prevent a default by Ukraine, and they would have bailed out Ukraine. But somehow, the US government arm-twisted the bondholders.

We have no idea why, but the bondholders did something that is very uncharacteristic in taking the loss on the $50 billion loan that was falling due. The IMF explained that since the West no longer lives by the rule of law, but by the rule based order, everything can go ahead.

We already know that one of the other articles of agreement of the IMF says that it's not allowed to make a loan to a country in war. The IMF said, and I'm paraphrasing, well, if the country is going to war for a purpose that the United States and NATO support, of course, since we're the arms of NATO, basically, and the US Defense Department and State Department, of course, we can waive the rules. The rules are meant only for when we want to apply them against recalcitrant countries that have difficulty paying the debt.

So they just made new loans to Ukraine to enable it to keep fighting the war. And the bondholders all pretended that somehow Ukraine isn't going to lose, that somehow they're going to come out solvent and pay the bondholders.

Nobody has any idea of what actually convinced them. But of course, since Blackstone and PIMCO are very close to the US State Department, there must have been a discussion, arm twisting and some kind of off-the-books promise that don't worry, we'll take care of you.

And apparently there are two plans that are set up for how Ukraine can pay the debts. Blackstone and JP Morgan are working together to organize what they say will be a bonanza of selling off Ukrainian resources once the war is over. And they think that this is going to be a huge market for American companies, European companies to buy Ukrainian land, Ukrainian public utilities and any assets they have.

So if Ukraine wins the military war, we know that won't happen. But if they did, then they'll cease to be a country that owns its own resources. Anyway, it'll end up looking sort of like Argentina or other countries that are told, pay your debts by selling off your land, selling off your mineral rights. And Ukraine has minerals, all in the Russian speaking areas, lithium and others. And the illusion is that somehow that all this money that will be paid to the Ukrainian government for buying out its assets will be used by the government to pay the bondholders and remain solvent.

That's basically the IMF strategy for the last 50 years. If Latin American countries or African countries can't pay their debts and have to borrow from the IMF, they have to sell off their mineral rights, their lands and the others.

There must be a plan B. And I've been trying to figure it out. And my suspicion is that the bondholders were told, well, if somehow a miracle happens and Ukraine loses the war, then the Eurozone will take the $300 billion that they've taken, seized from Russia, and they will give this to Ukraine as reparations for the war. And Ukraine will use the money they seized from Russia to pay the bondholders. That's only my guess, but I can't imagine the bondholders would have taken the loss right now unless they had these two, plan A and plan B, in their minds.

Well, as Radhika said, this is not a market relationship. It's a political relationship.

RADHIKA DESAI: And, you know, Michael, I mean, this is really interesting. And of course, I mean, it is interesting to see that in this case, the private creditors have been asked to take an almost 40% haircut on their loans to Ukraine.

Now, whatever the black machinations going on behind the scenes, the murky machinations going on behind the scenes, whatever the reason, the fact is that even if they actually took a real haircut, the U.S. got, well, there are two things. Number one, typically such haircuts come after the debtor has already paid an enormous amount already, more than what was originally contracted.

But secondly, you know, the United States has always, over the last, I would say, certainly 40-odd years, the United States has backstopped its financial institutions completely anyway. So through one way or another, these people are actually not going to lose.

But there is something really quite interesting. The fact that Ukraine can be, that private creditors can be asked to take a haircut for Ukraine will not be missed by the rest of the world because a lot of third world debt is to private creditors. These private creditors have benefited enormously by lending to third world countries. And we'll talk about that in a minute, exactly how they have benefited.

So when the debt crisis of the third world, which is already ongoing, reaches a critical point, I think that the third world countries will be in a very good position to point out that, look, you can ask private creditors to take such a substantial haircut in the case of Ukraine. Why not us? Our cause is even greater. And so, you know, I think that that will become very clear.

But there's a further thing that I wanted to say as well, which is, of course, that the United States has historically made money through war. I mean, you yourself have pointed out that the United States essentially became a creditor nation back at the end of the First World War, essentially by refusing to forgive the loans it had made to the European belligerent countries in the manner in which, for example, England had at one point forgiven its loans to belligerent countries in the Napoleonic Wars.

And when England brought up this point, [the U.S.] said, no, we are not going to forgive those debts. We want you to repay those debts. That's how the United States became a creditor nation. And of course, it has in some sense retained its control over this. So not only does the United States benefit by exporting more and more material to these arms and whatnot to the belligerent countries, as it is doing in the case of Ukraine or Israel or what have you, Taiwan and so on, its economy has become terribly dependent on war.

But it also does so when its financial institutions lend to these countries.

And you also spoke about the Russian assets. And, you know, what I find really interesting about this Russian assets story is that the United States is putting pressure on the Europeans to use the Russian assets because, you know, most, it's true, most Russian assets are actually in euros. And then smaller amounts are in pounds and in dollars in British and U.S. financial institutions.

But the United States is putting pressure on Europe also so that the financial institutions, the private financial institutions are actually a little wary of doing this because they don't want their other depositors to think that they're going to do this, because if the other depositors start thinking that they're going to lose the deposits, they're going to lose the business.

So they have been, so this is, again, part of turning the screws on Europe. If you get Europe to discredit its own financial system, while the United States remains sort of high and dry. So that's really quite interesting as well.

So, yeah, I mean, you can see the partiality. And I think, Michael, you've also, you know, this partiality that the IMF is showing to Ukraine has a longer history, right? They have been doing this sort of thing going back to, well, if not to 2014, at least certainly before this current conflict started.

MICHAEL HUDSON: I'd actually like to begin earlier. You made an important point that the debts of the industrialized nations, Europe and the United States, have all been war debts.

It started in the 13th century. The Roman church declared war on other Christian countries, mainly Germany, that didn't accept the Roman Catholic direction for control. And they fought against the orthodox Christian countries. And so they basically hired warlords like William the Conqueror to turn England into a fiefdom.

The problem is how they have armies that work for the Vatican, the warlords were sort of serfs. But how do you get the money to pay for the war?

It was the Roman church that in the 13th century that organized merchant bankers from Italy, the North Italian bankers, the Lombards, they were called to make loans to England and other countries going to war.

In order to do this, the Roman Christian church reversed the whole spirit of Christianity, saying charging interest is okay if you do it for a good Christian purpose that we approve, like going to war. From the 13th and 14th century right down through the 20th century almost all of the foreign debts, the domestic debts, the public debts of European countries were all war debts. And that's continued.

The important thing about war debts is they're not self-amortizing. Going to war doesn't give you the money to repay the creditors. And that's a problem.

Global south debts largely are not a result of international war. That makes the global south debts different from the European debts. You could call it a class war or what we do, a geopolitical war of the industrial nations against the industrial suppliers.

RADHIKA DESAI: It's an imperialist. It's an imperialist.

MICHAEL HUDSON: And it's a financial colonialism, you can say. To me, the problem began to loom already in the mid-1960s. In 1965, I was Chase Manhattan's balance of payments economist. And most banks had their own economists to judge how much money can third-world customers afford to pay. They had me looking at Chile, Argentina, and Brazil, and they said, see what their export potential is. See how their balance of payments is. How much surplus are they gaining that somehow we can get them to pledge the surplus for us to make loans? Because the international department of the bank made money by lending out to these countries.

I did a quick analysis and I could say, well, if you look at the balance of payments, they're already living by borrowing. They're already not generating a surplus. And you had banks already in the mid-60s begin to cut back on the loans because it was still— lending to these countries was still largely a market phenomenon back then.

They said, well, we're the creditors. We don't want to make a loan that goes bad. And the only way that we can secure our loans is to know that there is a [trade surplus] and a balance of payment surplus. That ceased to be the problem.

So at some point, and I think this must have been in the 1970s, I was a consultant for a number of brokerage firms and underwriters. And I was known as one of the three Dr. Dooms at that time. I said, I don't see how Latin America can pay to take on any more debt. They're already loaned up.

We had a meeting at the Federal Reserve and its officialturned to me and said, Mr. Hudson, you say that these Latin American countries can't afford to pay the debts. But suppose you did your analysis to England. England is in the same boat. There's no way of saying how it can pay its debts, is there?

This is when England was devaluing sterling. I said, yeah, that's absolutely right. And the Federal Reserve man said, well, but it does pay its debt. And how does it repay? We lend them the money because they're our ally. And if we tell the banks, you can afford to lend money to these countries with no visible means of support, but we'll stand back of them, then you don't need to do an economic analysis. It's a political analysis. And if they're friends, just like for England, we'll back them up.

Ws you know, England did end up devaluing. By the late 1970s, I was working for UNITAR. And in 1978, 1979, I wrote a series of, published a series of articles for UNITAR saying the global South cannot afford to pay. I went on record at a UNITAR conference in Mexico City saying this.

So it became already that they couldn't pay unless the U.S. would lend them the money. Well, by 1982, as we've discussed before, Mexico started the whole Latin American debt bomb by not being able to make the payments on its short-term debt called tessobonos that were yielding maybe 20% at that time because the market-based investors saw that they couldn't pay. It was apparent for a long time.

That led to a domino effect. Argentina, Brazil, and the remainder of the 1980s saw the Brady Plan come in and the international bondholders got together and said, we know that the third world countries, as they were called then, can't pay. You've got to write down the debts to something that is payable and at least will give the creditors an idea that yes, at this written down level, they can afford the service of the debts.

This agreement wasn't believed by American or European investors. In 1989 and 1990, I was hired by Scudder, Stevens, which was a money manager, to start what became the world's first sovereign debt fund, mainly for third world debt.

When they hired me, they said, Michael, you're known as Dr. Doom. You've been saying that the countries couldn't pay. Suppose we start a third world bond fund and it'll only be a five-year fund. Do you think that Argentina, Brazil can afford to make the payments on this debt for the next five years?

This was at a time in 1989 when Brazil and Argentina were paying 45% interest on their dollar bonds. Just imagine, you know, in two years, you get all of your money back in interest and you still have all of the bonds.

Scudder went all around the United States meeting to banks, not a single bank, not a single investment fund or pension fund was willing to invest. They said, no, we've got burned with the Latin American debt bonds. We don't want any part of it.

They went to Europe, England, Germany, France, nobody would buy anything. So finally, they went to Merrill Lynch and said, can you underwrite these bonds? Let's find some country that might buy these bonds at 45%.

Merrill Lynch told its Latin American office in Argentina to issue shares in this sovereign debt fund. Scudder wanted to call it the Sovereign High Interest Trust, SHIT, but I think they had a name that didn't quite get that.

The only people who would buy Argentinian and Brazilian debts bought them in the Argentinian market where the shares were sold and the company was organized in the Dutch West Indies. Americans were not allowed to buy these shares. When you have an offshore fund, that usually is only for foreigners.

The countries that were buying Argentinian and Brazilian sovereign dollar debts were members of these countries themselves. And obviously, they must be the oligarchy that was doing this. No doubt, the central bankers and the president's family bought them because, well, we're in charge of paying the debt, so of course we'll buy the fund. And if we're going to default, then we'll sell the debts to some sucker. But as long as we're in charge of deciding to pay the dollar debts, we can afford to buy them.

You had this client oligarchies throughout the third world were basically buying this third world debt. And the fund took off. It was the second best performing fund in the entire world in 1990. I think an Australian real estate fund came first.

All of a sudden, this led to a new flood of lending to the third world countries, largely because the IMF said, well, these countries are in the U.S. orbit. We're supporting their governments. After all, this is after the Chilean overthrow when the U.S. government had assassination teams all over Latin America putting in place client oligarchies that, of course, were going to pay the dollar debt.

At that point it ceased to be a market relation. It became completely political and all of the U.S. and European investors began to jump in.

RADHIKA DESAI: Well, I just like to clarify. This is very interesting, Michael. And I just like to clarify that I wasn't saying that debt is sometimes a market relationship and sometimes a political relationship. I think that is always a political relationship. And even the so-called risk premium that allegedly poor countries are supposed to be paying that, you know, their lending to them is riskier. So that means that they have to pay higher interest rates. Studies have shown that, in fact, this so-called risk premium is an entirely manufactured thing. And that these private creditors make far more money lending to poor countries than they make lending to the rich countries.

In that sense I would say that credit is always a political relationship and all sorts of things, including social prejudices, come into play so that, you know, poor countries are almost always considered a bad bet. And therefore, they have to pay higher interest rates.

They get worse terms, just as within a country, certain marginalized groups, whether you're if you're a Black American or a Latino American, then you will have to pay higher, you know, your credit rating will be lower and all these sorts of things. So in these ways, I think that it is always a political relationship.

You've already segued into talking about third world debt. So let's talk about third world debt, because I think that, you know, you gave a good narrative, but there is one very key set of events that I would like to particularly draw attention to, because that will allow us to look at the current debt crisis in a historical perspective.

I'm speaking of the debt crisis that erupted in 1982. But of course, genesis goes back at least a decade before that. So it goes back actually to the closing of the gold window, the collapse of the Bretton Woods system, the rise in the price of oil, which was first quadrupled in the early 1970s, and then later doubled again in the late 1970s, in part because of the decline of the dollar. The dollar fell so hard that all these oil exporters said, well, if we are going to collect in dollars, we need more dollars, prices for our oil.

When oil prices were quadrupled people remember it as a big shock to the system. But behind the scenes there was something else that was happening, which is that, and this was the beginnings, you know, Michael, you and I have had our discussions of the dollar system and so on.

And one of the things we emphasize is that after 1971, after the link between the dollar and gold was broken, the dollar was placed on a new kind of basis. And that new basis is what we call financialization, that is vast expansions of dollar-denominated financial activity, which artificially increased the demand for dollars.

So now what began to happen is that, first of all, Henry Kissinger, in his typical Machiavellian fashion, in the aftermath of the oil shocks, went off to all the Arab countries, the oil exporting countries and said, look, folks, we are okay, you know, if you must have higher prices for oil, that's fine, we'll accept that. But you should put the extra money you're getting, you should put them, you should deposit them in Western financial institutions, in dollar-denominated deposits. And indeed, that is what they did.

So Western banks became flush with money. They were suddenly sitting on vast piles of money. And you think that would be a good thing for banks. But actually, it's a big headache for banks, because if you're sitting on piles of money on which you have to pay interest, you've got to employ it somehow to earn the interest that you will pay the depositors. So you have to find borrowers.

And that's when Western financial institutions went on an absolute lending spree, lending to anybody, any third world country that would borrow from them. And indeed, they even lent, sorry, just one final point on this point, just one more thing, they even lent to socialist countries in this time. Sorry, you wanted to say something, Michael.

MICHAEL HUDSON: It wasn't only the banks. By the 1990s, you had private bond funds come in.

RADHIKA DESAI: I'm still talking about the 1970s. Sorry, I'm still talking about the 1970s. So maybe I'll finish my story of the 1970s, then we'll come up to the 1990s. Because it is a really interesting story. So at this point, they started lending like crazy.

And in this context, in the 1970s, remember, inflation was very high, and interest rates were barely keeping up with it. So that actually, a lot of the time, the real interest rate was negative. So third world countries who had been asking to borrow for such a long time for their industrialization and so on, they, in the words of one writer I was reading, I forget the name, but he basically said it was like a magic money machine, you know, that they could get unlimited quantities of credit for next to nothing. In fact, the banks were paying them to borrow if the interest rates were negative. So this was the context in which a lot of this borrowing took place.

But inflation persisted. And finally, the Federal Reserve, the incoming Federal Reserve Chairman, Paul Volcker, decided that he was going to roll up his sleeves, and he was going to absolutely kill inflation by inducing a recession. So what he did was he simply restricted money supply. And he said, I'm just going to restrict money supply. And I don't care where interest rates go.

And they leapt up, and they went up from, you know, negative real interest rates, to like, like 15 and 18 and 20% double digit interest rates. And so suddenly, the debt burden of all these countries, you know, it was not changed because of any secular development. Their condition changed as a result of a single decision on the part of a single decision maker.

So Paul Volcker induced a crisis within the United States, a very long recession, but in the third world, he induced the debt crisis. And so that debt crisis erupted, particularly with Mexico, Brazil, and Argentina, originally defaulting on their debt in 1982.

And I even remember back in the day, Fidel Castro, actually saying to them, look, you folks have already paid back more than enough. You don't need to, you should repudiate this debt, you should just give up this debt, etc.

But unfortunately, that's not what happened. And all the third world countries were essentially, Latin America was followed by Africa. And these two continents, in particular, actually went through the ringer, really, economically, they were in the ringer, they experienced economic retardation.

Suddenly, they had to expand their exports, given that they had barely industrialized, all they could export was what every other third world country would export all sorts of primary commodities, be it coffee, be it cotton, be it tea, be it cocoa, be it, you know, strawberries, what have you, you couldn't walk for all sorts of fresh third world primary commodities. Cotton, which was hard to buy, was suddenly flooding Western markets. Silk, which was hard to buy, was suddenly flooding Western markets.

So you got this big bonanza, Western countries got to buy cheap things. Because of course, if every country that can produce coffee is exporting coffee, if every country that is producing cotton is exporting cotton, prices fall. And so they had to run harder and harder to stay in the same place. So third world countries really went to the ringer. And of course, social expenditures were cut, and all these sorts of things.

So that was the genesis and the eruption of the third world debt crisis. And in a minute, Michael, I know you want to say something. So I'll let you come in. And then we want to go into talking about the current debt crisis.

MICHAEL HUDSON: I want to just summarize what you said. When the oil prices were quadrupled, the deal that was made with Saudi Arabia is, you can charge whatever you want, but keep your earnings in the United States. That flooded the US market with money. The money was put in the US banks. And you're right. The bank said, what are we going to do with all this money? They had to find customers. And the paying customers were the third world debtors.

What brought this to an end? When Paul Volcker raised the interest rates, as you said, all of a sudden the international investors sold their foreign holdings and said, we're going to buy US treasury bonds yielding 20% in 1980. I remember that very well. So you're right. That led to the whole crisis. All of a sudden, no more of this gusher of Saudi dollars in US banks was available. And when the credit stopped, all of a sudden, Mexico and Latin American countries couldn't borrow the interest to pay.

Throughout the 1970s, as you pointed out, basically, countries would borrow and they didn't have any problem paying the debt because they borrowed the interest. That's a Ponzi scheme.

RADHIKA DESAI: The commodity prices were also high. Remember, that was the inflationary 1970s because commodity prices were high, so they could earn the money to pay. I mean, it's not given that a third world country cannot earn what it is to pay.

The real difficulty is that the lending took place not because third world countries needed the money. The lending took place because the private creditors needed to lend. So they essentially went touting these loans to third world countries.

MICHAEL HUDSON: Yes, I agree. Yeah.

RADHIKA DESAI: So anyway, let's look at this. I have some charts. You know, UNCTAD, as I mentioned earlier, has published a wonderful report called The House of Debt. It's a 2024 report, and it's got some really instructive graphs and charts, and I'm going to share some of them.

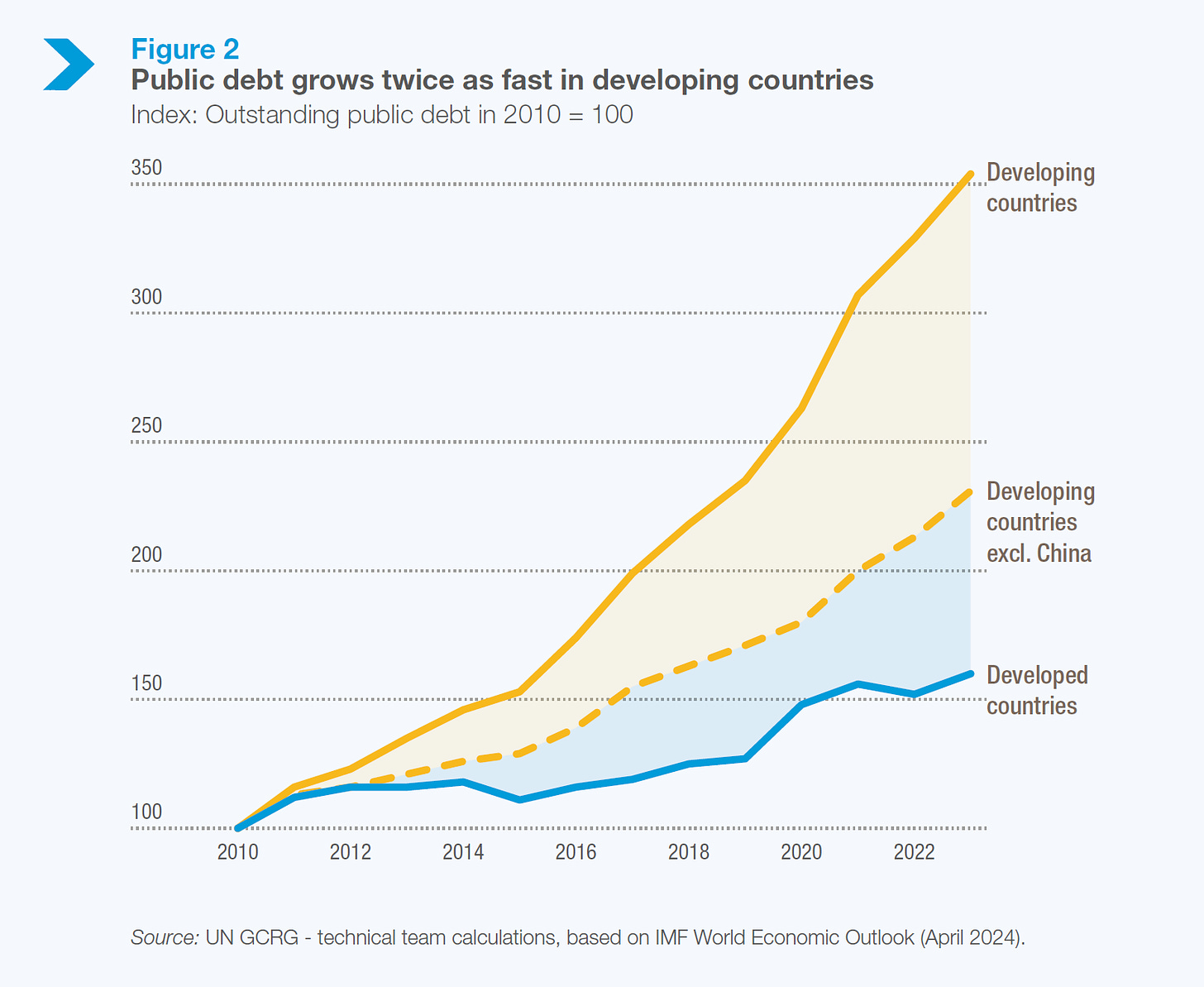

So here we go. This is a chart, Michael, that shows that public debt has grown twice as fast in developing countries:

So if you see here, you have the developed countries and their debt has grown. And of course, we've seen that public debt has grown particularly since 2020. Sorry, where did my cursor go now?

It has grown particularly since 2020, and you can see the solid yellow line is the developing countries. And this basically is an index line. So, 2010, imagine that all countries, all these three categories of countries' debt was 100 in 2010. So, it has gone for the developed countries from 100 to about a little over 150, maybe 160.

But for developing countries, the total public debt has gone from 100 over some 12, 13 years to over 350. So, that's really quite interesting.

And of course, what's really interesting as well is that, of course, if you look at developing countries excluding China, it's much less because China has been borrowing a lot. But of course, we're not worried about China's credit worthiness because China has plenty of money to repay back. China has enormous productive power to pay back.

So, the problematic bit is the middle bit between the developed countries' line and the developing countries' excluding China line. That's the problematic bit.

MICHAEL HUDSON: It's hard to begin in 1990 because if you had it in 1990, you'd have the 1998 Asian debt crisis. And this was the whole collapse of the Asian currency and the result of the debt crisis for almost everywhere except Malaysia. There was a huge sell-off of third world, especially Asian—

RADHIKA DESAI: Yeah, but that wasn't public debt, Michael. That was really a Western capital going into these countries. I mean, I think we have to bracket, we have to take out, we have to expand another show talking about the 1998 debt crisis. So, in 1998, the currency crisis is what they were because private capital had been going into all sorts of capital markets. Western private capital had been going into all sorts of capital markets in these so-called big emerging markets.

But let's come back to this public debt crisis for now, and then we'll do another show on that phenomenon.

So, this is the one chart, and another chart is also quite interesting here:

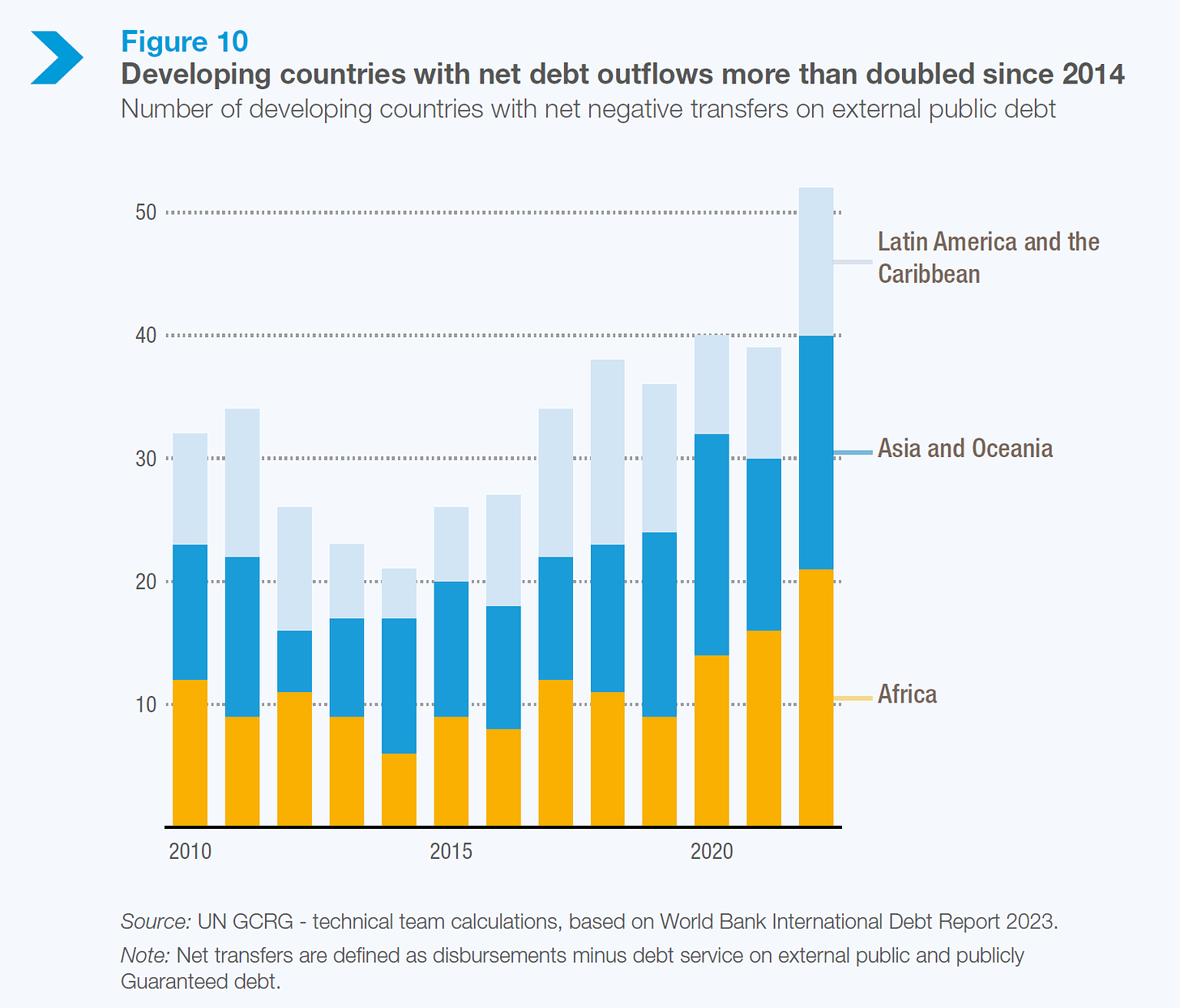

So, developing countries with net debt outflows have more than doubled since 2014. So, once again, you see here, these are all the developing countries, and then they are divided between Africa here, the dark blue is Asia and Oceania, and then Latin America. And so, you can see that in 2014, it had come down to very low point. And since then, essentially this debt has risen and it has gone from about a little over 25 to over 50.

So, you can see that the actual amount of net debt outflows have more than doubled. That is to say, in this period, more money has been coming out of these countries than going into them. So, that's another really quite interesting point.

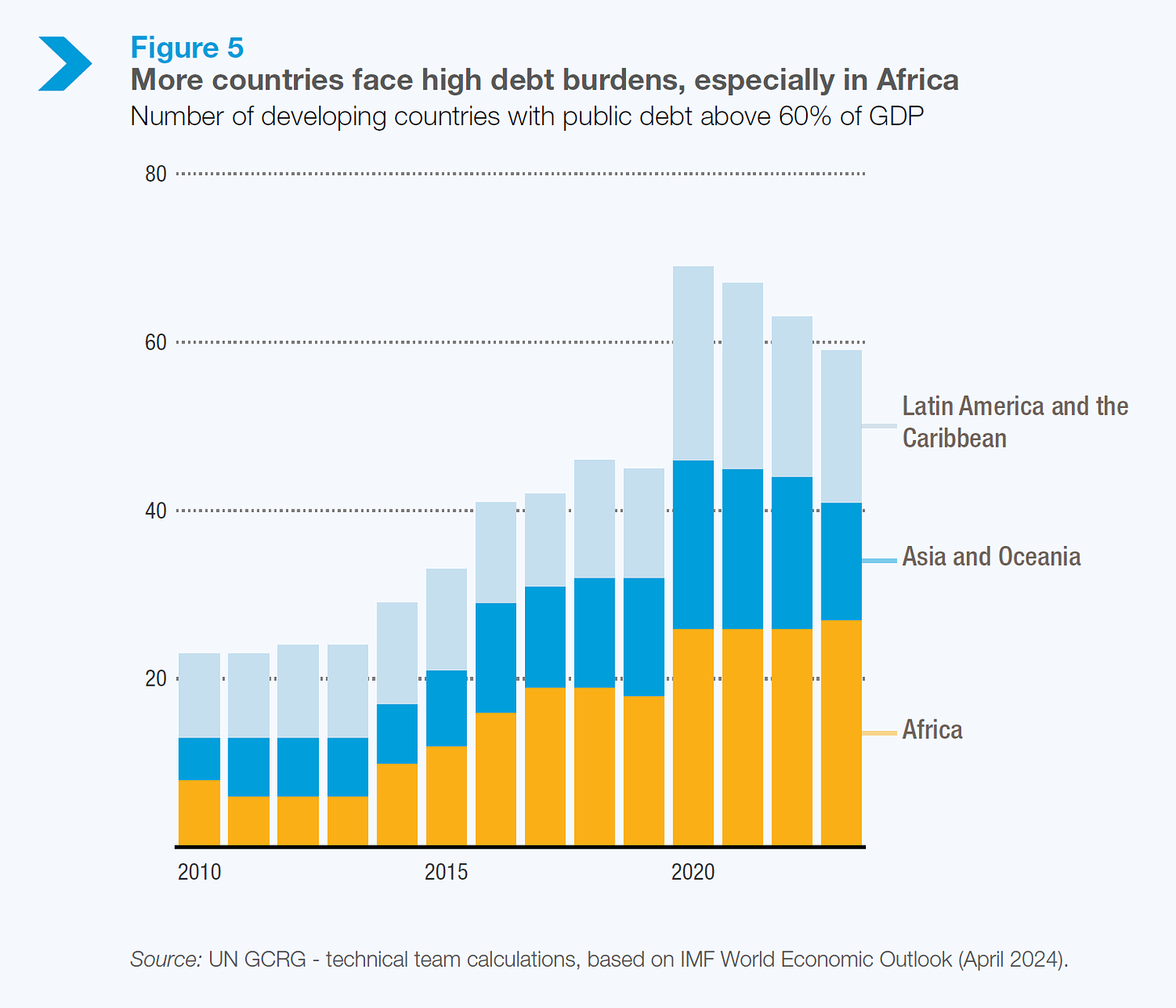

And then this figure is also interesting:

More countries face high debt burdens, especially in Africa. So, this is just a chart of the number of developing countries, again, in these three regions, where public debt is above 60% of GDP, which is about when the IMF starts raising alarms.

And just for comparison's sake, the debt in the United States has now gone, I think, above 100% of GDP recently. I think it's more like 110 or 20%. I'm not sure about the exact figure, but so you can see by comparison that these countries, of course, have lower carrying capacity, or at least are considered to have lower carrying capacity.

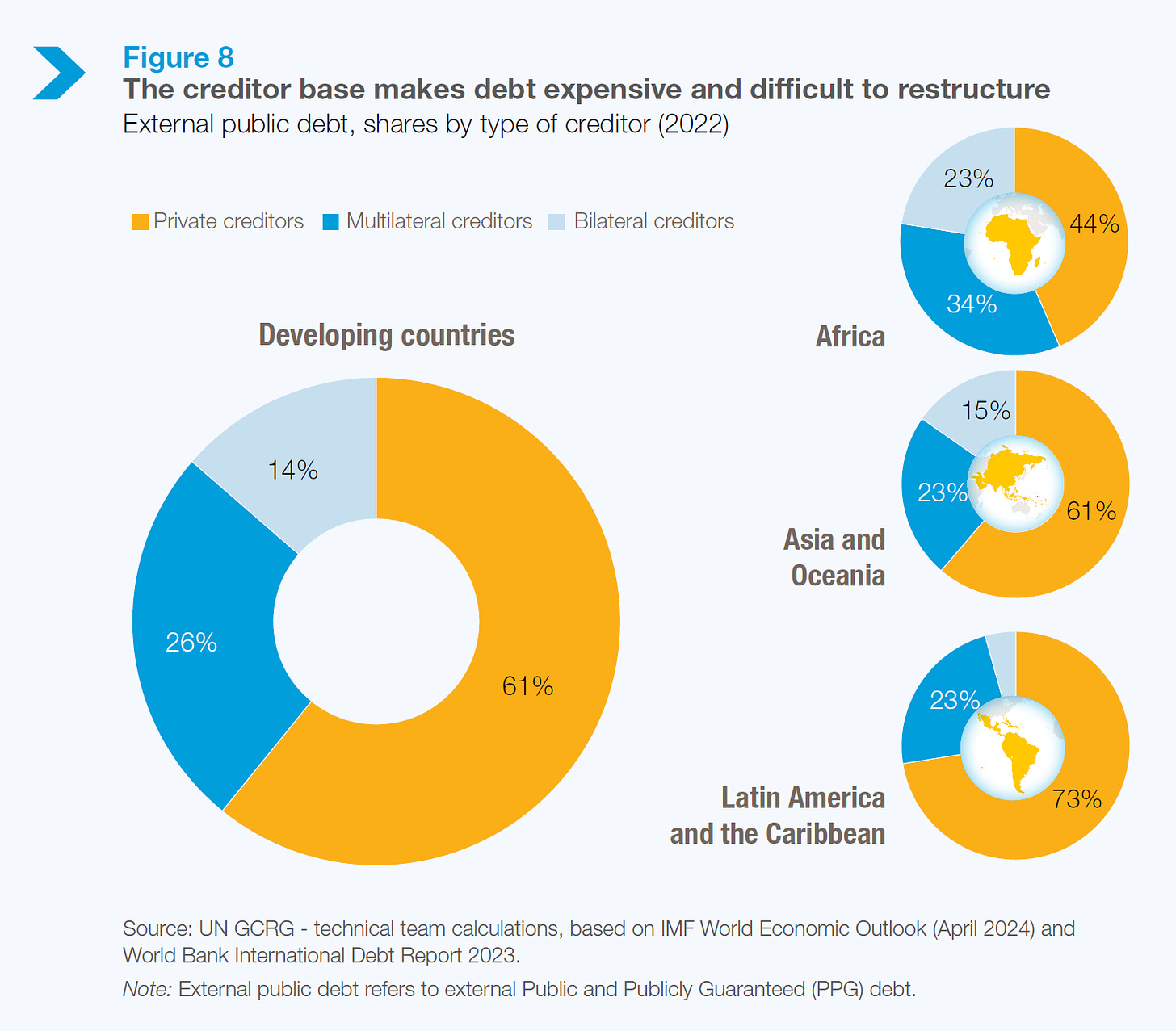

And this chart is really interesting:

So, we talked about the third world debt crisis earlier, and there was some private capital, but now you see that for developing countries as a whole, private creditors are responsible for 61% of total developing country debt, which is higher in the case of Latin, the highest in the case of Latin America, as you see in one of the smaller bias charts, and then a little less in case of Asia and Oceania, and the least in the case of Africa.

And then the other two categories, which are bilateral creditors and multilateral creditors, constitute the rest.

So, private capital, private money, is playing a very big role in the genesis of this debt crisis.

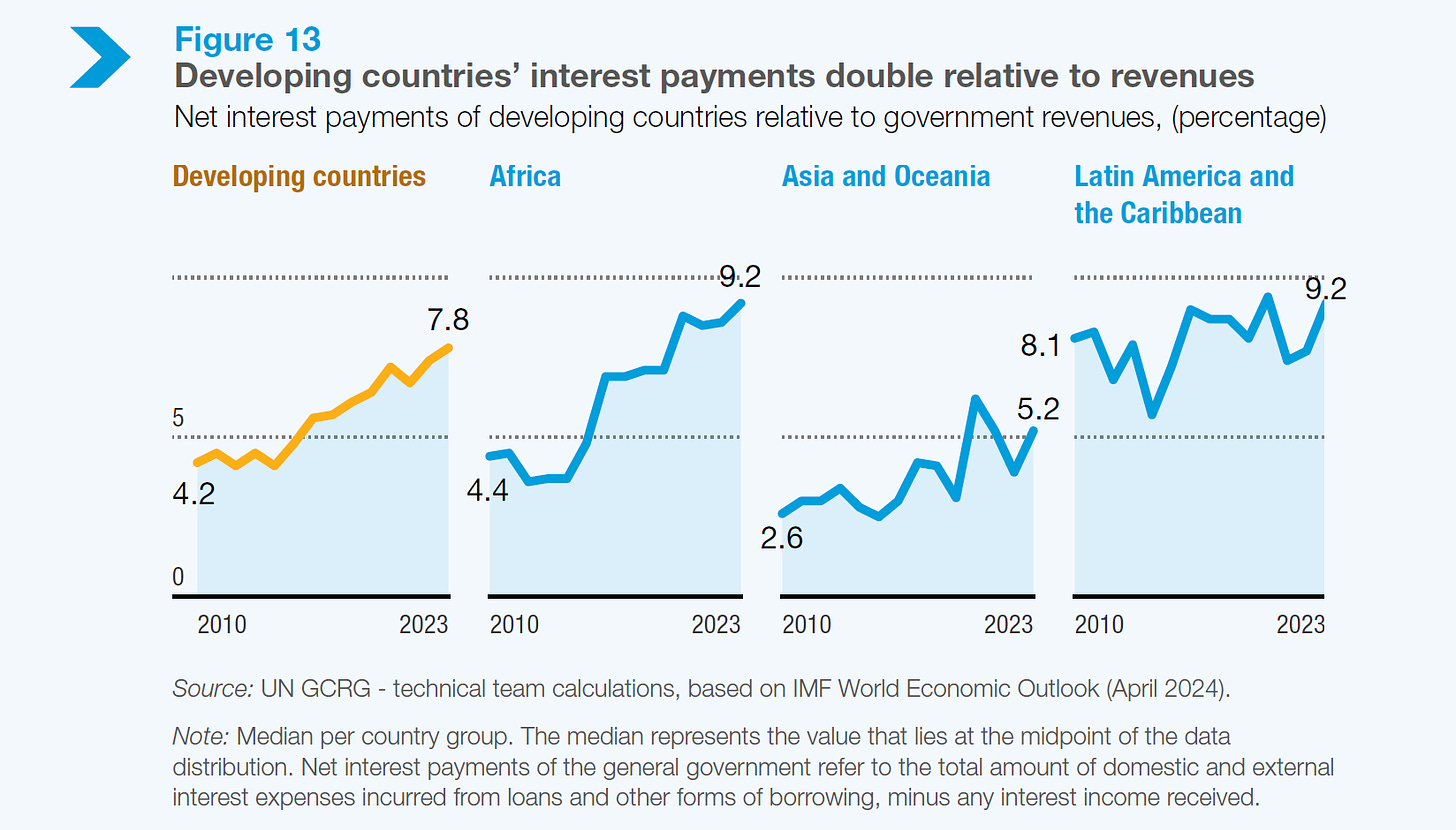

And then another figure shows that interest payments have doubled relative to revenue:

So, if you take the public revenues, the tax revenue intake of these governments, for developing countries as a whole, interest payments have gone from 4.2% of revenues to 7.8%. And then again, in the case of Africa, the rise is the steepest, with the rise being less steep in the case of Latin America and the Caribbean, where it was already very high, and rising less steeply in the case of Asia and Oceania.

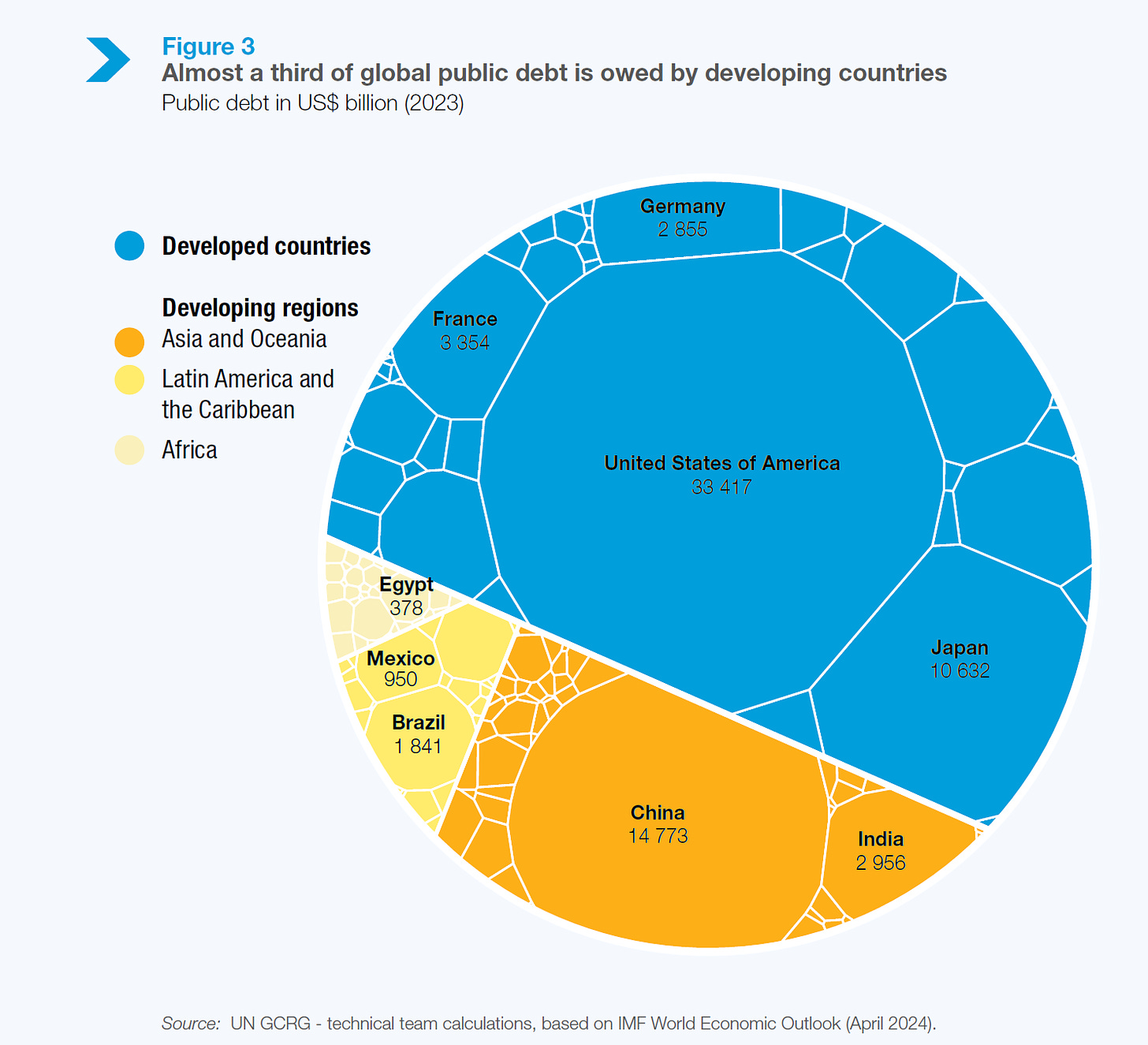

And then this graph is also fascinating, and Michael, feel free to come in, but I find this graph really interesting, or this figure very interesting, because what you're looking at is the total public debt of the whole world, and then which bit of the world has generated what.

So, you can see that the United States, of course, has generated the biggest pile of debt. Japan is a close second, but of course, you have to remember that public debt in Japan is largely owed to Japanese people, but nevertheless, it is the public debt here, and then France, Germany, et cetera, and then other countries.

And in the developing world, so first of all, the share of the developing world is much smaller. And then within that share, so this debt crisis is occurring, even though bulk of the debtor-creditor relationship are in this charm circle that Michael was talking about, in which essentially the capacity to pay is not doubted, and if it is doubted, in some sense, the Federal Reserve is there to backstop it.

Yeah, Michael, go ahead.

MICHAEL HUDSON: The situation's much worse than what your charts show. Debt to GDP is meaningless for the third world countries and for almost any country outside of the United States. Debt is not paid out of GDP. In America, you could say it is, but the debt of the Global South countries, Asian countries, is not in their own currency, it's in dollars.

The question is, how do you turn their GDP into dollars? These countries do not have, unlike the United States, these countries do not have debt in their own currency. So what you really need to compare and to look at is what is the trade surplus and the balance of payment surplus of these countries?

Wwe're talking like 1,000%. And now just look at this chart that you just put up. Take Africa from 2010 to 2023. Up to 9%. 9% means you're having a doubling time in about eight years. Now, it's been much more than eight years since 2010. You've had the debt of Africa double and quadruple simply by interest payments.

So most of the debt of these countries, the Global South countries, is not money that's been borrowed. It's interest that have accrued on their existing debt. And they can borrow to pay the interest, but all of that is an accrual of interest, not loans. The actual flow of new credit to these countries has already dried up years ago. It's just their accruing interest on the past debts that they took on being assured that somehow with the IMF coordinating things, it was looking after them and the pretense that they would be able to pay these debts when there was no way in which most Global South countries could repay these debts, especially dollarized debts without some means of earning dollars, which they really don't have.

So what did they do? That little decades that you're showing when they were essentially privatizing, only making the debts by borrowing the interest and to some extent selling off their patrimony.

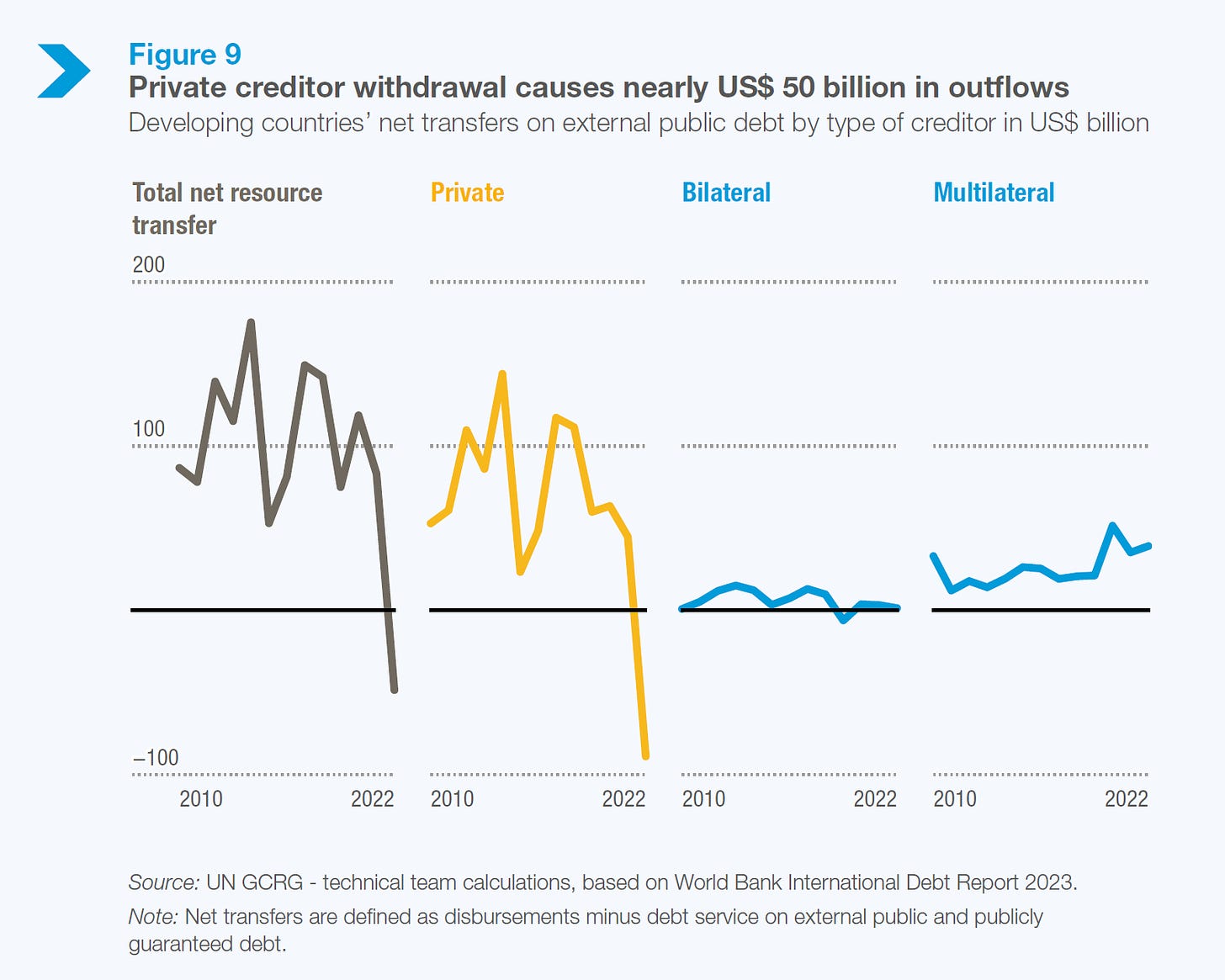

RADHIKA DESAI: Correct. And what you're talking about, Michael, which is the withdrawal of funds is actually shown in this set of charts.

So this shows private creditor withdrawal causes nearly US 50 billion in outflows. Developing countries' net transfers on external public debt by type of creditor. So you can see here that in the total net resource transfer has gone from whatever it is like, like just under 100 in positive. So their capital inflows into these countries, it went up to whatever 170 or something, then dip down in the middle in about 2014 or so, but then it has gone down massively and it has become negative, negative 50 or so billion.

Out of that, however, bilateral debt, that is one country lending to another, or multilateral debt, that is groups of countries or organizations like the World Bank, IMF, et cetera, lending to a given country, they have remained relatively steady.

What has happened is that in response to rising interest rates in Western countries, essentially the private capital has withdrawn from these markets. So essentially they are the ones, it is the withdrawal of private capital that has created this problem.

MICHAEL HUDSON: I don't like the euphemism resource transfers. Not a single penny of resources was transferred to these countries. A financial loan is not a resource. A resource is tangible means of production that help you grow. A resource is a factory. A resource is some means of production.

Giving countries the money, especially the money to pay their debts, isn't a resource. It's a financial claim. It's the opposite of a resource. It's a debt that they owe, a financial handcuff and a straitjacket on them, not a resource transfer. This is IMF creditor talk.

RADHIKA DESAI: And so, sure, absolutely. And this is another important point that you're making because I think that, you know, particularly Western debt seems to be of this sort that, you know, essentially used to squeeze out, you know, more and more capital out of these countries without contributing to their ability to produce.

Whereas I think more recently, the rise of China as a major creditor has contributed far more to creating productive capacity in these countries, whether it is farms or mines or factories or infrastructure or what have you.

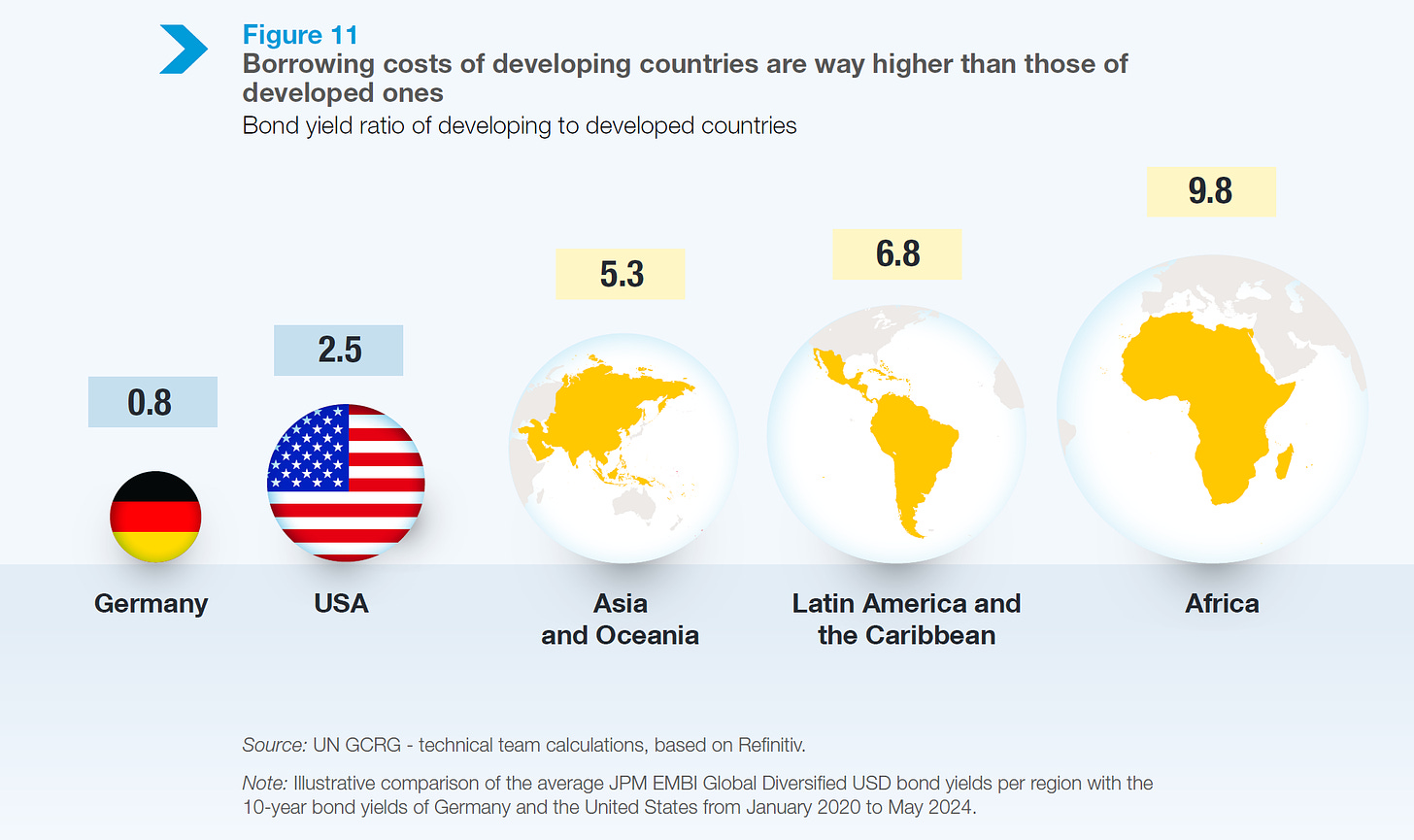

But here's the other thing we were talking about. You know, we were pointing out that, you know, third world countries pay a higher risk premium. So, you know, borrowing costs of developing countries, this report says, are way higher than developed ones.

So what is the bond yield ratio of from developed to developing countries?

So Germany pays 0.8% for borrowing. The United States, interestingly, pays much higher than Germany, in fact three times as high, which is 2.5%.

Asian countries pay 5.3%. Latin American and Caribbean countries pay 6.8%. And African countries pay nearly 10% interest for these loans.

Now, this is essentially the outlines of this debt crisis that we're looking at.

But the genesis was also very similar because, you know, earlier we were emphasizing how the genesis of the debt crisis of 1980, that burst open in 1982 and continued for the next two decades, more or less. This, the genesis of this debt crisis lay in the desperation of Western financial institutions to lend to third world countries.

So you might well ask, where did the desperation of the Western borrowers to lend come from this time?

Well, the story is very simple. As people know, already in the aftermath of the dot-com bubble, Alan Greenspan, was it? Yeah, I think it was still Alan Greenspan was pursuing, beginning to pursue a low interest rate policy.

And then in the middle of the 2000s, he was forced to start raising interest rates because of the downward pressure on the dollar, which eventually after interest rates reached about 5% or so, pricked the housing and credit bubbles.

And in the aftermath of the mayhem that followed, the Federal Reserve, sorry, and I should add one other thing. He was pursuing a low interest rate policy because he felt that that was the best way of keeping the housing bubble going. And indeed that was correct because the housing bubble at that time, I note this in my book, Geopolitical Economy, the housing bubble was the only thing that was driving forward any kind of economic growth. I mean, it was pretty anemic, but that's all you had. Investment was at absolute rock bottom. So they thought, all right, let's let it rip, let the housing bubble rip and we will be fine. But of course, then that put downward pressure on the dollar because how long can you have 2% and 3% interest rate policy and have a strong dollar?

Well, the dollar was weakening and this was too much. Prices of imports were growing up, prices of oil was going up. So Greenspan started raising interest rates and lo and behold, the housing and credit bubbles burst. Now in the aftermath of the housing and credit bubbles, of course, they pursued an even lower interest rate policy.

The ZIRP, the so-called zero interest rate policy came in, they had quantitative easing, they had all sorts of ways of pushing more and more money into the banking system, but offering them less and less in terms of interest, which means that they were forced to, they have been essentially forced to take ever riskier, ever greater risks in order to make a return. And among the risks they now became willing to take was to lend to third world countries. And so third world countries then once again began to enjoy a big bonanza in terms of incoming funds.

But of course, that again, the same thing has happened. Inflation came back in the United States and inflation essentially started putting pressure on, in order to quell inflation, the Federal Reserve has been forced to start raising interest rates, except as everybody knows, he has raised them to about five, 5.25%, but he has not been raising them, Jerome Powell has not been raising them any further because even bringing them to this point has set, has triggered a kind of slow motion financial crash whose beginnings we saw with the crash of the Silicon Valley Bank and other such banks we saw in March of 2023.

And there are many other, we are now living in the time, not just of this or that bubble, but the everything bubble. And it's quite possible that all these asset markets will come crashing, but nevertheless, these interest rates have gone up and they have created a debt crisis for developing countries who are already suffering from COVID, from the economic setback that was COVID, who are also suffering from high oil prices. They're also suffering from high food prices. They're also suffering from high fertilizer prices and all these things. So you bring all this together and it's a recipe for disaster for many third world countries.

MICHAEL HUDSON: How can the IMF make loans to these countries to enable them to pay the debt and keep rolling it over, lending them the interest rates, not to default, if they have the problems that you describe? This is not a market relationship. If we define a market relationship as creditors act responsibly, they won't make loans to countries that can't pay their debt because the market relationship is supposed to balance risks with the interest rate. That hasn't happened at all. The risks are so high that the interest rates would have to be much, much higher.

So there has to be another explanation. The explanation is the IMF and the American policymakers know that the debts can't be repaid. What we're saying is that the debts can't be repaid is not a secret known only to us. The reason that loans are made to countries that can't be paid is precisely because if a country can't pay it out of its export earnings, out of its other balance of payments and flows, it has to do what an individual would do. If you borrow money to the bank for a mortgage and can't pay, the bank gets your house. That's what happened to the global south countries.

The IMF will go and say, oh, you can't pay? Well, we'll make you the loan in order so that your currency won't devalue again and raise your consumer prices as foreign exchange import prices go up. We'll make you the loan, but you have to sell off your utilities, your oil and resources. Let's bring in our friends from the World Bank. The World Bank is supposed to help you, remember?

The World Bank has all of this advisory group to say, we will help you privatize your resources. We will do for the global south just what BlackRock is doing for Ukraine. We'll help you sell all of your means of self-support to the foreigners. We can help you stop being a sovereign country and become a good, what America calls democracy, letting foreigners buy all of your assets that you're privatizing, Margaret Thatcher style.

This calls into question, what is a sovereign debt? Are these countries sovereign if they have to sell off their basic means of support to foreigners? They're not sovereign at all. The IMF and the World Bank work together as a one-two punch to prevent other countries from taking control of their own fate, to prevent the global south countries from using their tax revenues to actually invest in social spending and capital formation and subsidizing their own agricultural industrial self-sufficiency instead of being able to do this.

The function of having to load down countries with debt is all of their domestic fiscal surplus is paid to foreign creditors, not for use in their own countries. This means that debtor countries have ceased to be sovereign in any meaningful way of the world.

I think that that is the logic, is this consciousness is spreading among the global south countries. They realize that paying foreign debts is a kind of financial neocolonialism, except it's colonialism without the gunboats, unless you're like Chile and America has to come in and do a regime change operation. So this has transformed the whole issue.

RADHIKA DESAI: This is also an interesting point. You know, I remember back in when the IMF and the World Bank had turned 50, there was already a movement to abolish them, largely, you know, basically for the same reasons that you have just enumerated.

They have always acted as bailiffs of foreign, Western foreign capital. And that's what they continue to do today. But you know what? And you had mentioned, Michael, the 1998 financial crisis. In the aftermath of the 1998 financial crisis, the manner in which the IMF intervened in the case of South Korea, which was no underdeveloped country, is an extremely diversified, industrial, sophisticated economy.

And they essentially tried to treat it in the same way as you described, you know, forcing sort of fire sales of assets, both private and public on South Korea and so on.

A lot of countries began to take note. And actually, the IMF and IMF in particular, but IMF and World Bank loan portfolio shrank because third world countries also began to see that they were getting money, of course, privately after 2000. But also, they were getting money increasingly, Chinese credit was becoming available.

So, as a result, the role of these institutions has diminished. And they are no longer as powerful. I think that they are trying to hang on to some kind of role internationally. But I think that in the new environment, exactly how this debt crisis will be resolved is going to be interesting.

For example, in our other shows, we've been talking about how the world majority is showing increasing signs of solidarity, BRICS countries, BRICS is expanding, China is creating new alliances, and so on.

Now, will this lead the debtor countries to create a joint front and say, okay, you want to deal with us as a group of creditors, we will deal with you as a group of debtors. And we will see where this goes. I think if such a thing happened, that will be quite interesting. I think that it could happen, it really depends.

And I think the more, you know, earlier at the beginning of the show, we were talking about the fact that if private creditors can be asked to take a very substantial haircut for Ukraine, in order to fight a war, why can't private creditors be asked to take a substantial haircut for third world debt so that children may eat, or go to school, or have clean water, or what have you.

So, in all of these ways, I think that debt, the political character of debt has become more and more in the open. So, it is also with the weaponization of the US financial system, because of the credit, you know, because of the sequestration of Russian assets, and Venezuelan assets, and Afghan assets, and what have you. So, the political character of all these things is becoming more clear.

So, the question then is, will the world majority, will the developing world, will the developing world, along with Russia and China and so on, actually take, actually act accordingly? Yes, please go on.

MICHAEL HUDSON: Here's the problem. You can't borrow your way out of debt. All that does is add yet more interest payments, and it's a pomzi scheme. The fact is that global south countries and other countries can't pay the debt out of their existing output, because they can't print the dollars. They can only print their own currency, and if they throw that on the market to buy dollars, the currency is going to go way down, their import prices go up, and they have inflation.

A country can say, okay, I realize, like Argentina or Brazil, we realize this, but if we don't pay the debt, then the credit of the bondholders can do what they did to Argentina under Judge Grisa. Grisa can say, well, grab all of their assets abroad that you can do.

You mentioned that China changed the picture. There's only one way that third world countries can repudiate the debt, and that is banding together and saying, well, we're going to repudiate the debt, and if the bondholders in America and Europe try to grab our resources there, then we'll retaliate by nationalizing the foreign ownership of our own land and mineral rights and public utilities that we've had to sell off under the IMF promises that this will make us more competitive.

The problem goes way back to 1955 at the Bandung Conference when the non-aligned nations already saw there was a problem, and you mentioned before how this was recognized in the 70s, recognized in the 1980s and 90s, but at that point, there was no way that countries could band together.

The only way that I see in practice for the Global South countries not to pay their debts and say, I'm sorry, you've made bad loans. If you make a loan that we can't pay, then you've failed in doing what creditors are supposed to do, a market analysis saying we'll only make loans that can afford to be paid. Otherwise, you're making us a loan that can't be repaid, and we're not going to sacrifice our growth and sell off our natural resources just because you've made a bad loan. That's your problem, not our problem.

The problem for debtors is to make the bad loan problem a problem of the creditors, not their own problem, and that requires a restructuring of the whole international financial system and actually the kind of break between the global majority and US-NATO that we've been talking about. So far, even though there's talk of a BRICS bank, there's nothing of the scale that we've spoken about that is done. There still needs to be a change in consciousness that the debts can't be paid and shouldn't be paid and are in fact odious debts.

This is the consciousness that I think it may take another year or two, and the reason we're having these geopolitical shows is to try to spread this consciousness of saying this is not a problem that can be solved. It can't be solved. It's a quandary, and the way to avoid the quandary is to change the whole system. Say, okay, it's been a bad system for the last 80 years of Bretton Woods and US domination. It's time now for us to be a sovereign country and say our own growth comes before paying the debts to foreign creditors.

RADHIKA DESAI: I think Michael is absolutely right that there are some really knotty issues here to untangle, but I would say that in many ways, the search for alternatives to the dollar system, to this predatory dollar system that Michael and I have talked about to such an extent, the dollar system which requires these forms of predatory lending that we have been talking about today, this dollar system, it's quite possible that it will collapse before alternatives are in place. That is why things are so urgent, because essentially, you know, we showed you that chart with US debt. US debt is ballooning beyond the capacity of markets to sustain it.

The IMF has warned again and again in recent months as to the unsustainable quality, as this unsustainable quantity of US debt, and the Federal Reserve is already supporting treasury markets because treasury markets are collapsing. This idea that the United States can issue as much debt as it wants and the world is, the grateful world will buy more and more of it, it's complete rubbish.

The world is not ready to absorb the quantity of debt the US is willing to print. And once the treasury market goes, so will a heck of a lot of other things.

And as I said, the Federal, and maybe we should do another show, another one of our dollar system shows, because really things are coming to a head, because the Federal Reserve can neither lower interest rates because of inflation, and if it doesn't lower them, then the financial crisis will come, and nor can it raise them further in order to finish the job, because that will simply mean the financial crisis will occur sooner.

And if it does not do that, inflation will undermine the value of the US dollar. So one, it's damned if you do and damned if you don't. And that's where we are back to the dollar system, but today we've had this really interesting conversation about the political character of debt, the power of debt and the debt of power.

So we will see you again soon, but in the meantime, please like our show, please share our show with lots of people, and see you again very soon. Bye-bye.

https://scrapsfromtheloft.com/movies/money-masters-how-international-bankers-gained-control-of-america/

There is a lot more planned and underway on this front.

The combination of this carefully engineered financial crisis in the third world, based on the US fed jacking up interest rates while stimulating commidity price rises driven by war and conflict + the existing need to implement sustainability and prevent climate change....... is also designed to "shake out the tree" so to speak.

If you notice, at every policy forum the rich and their financial sector companies they own, in chorus constantly bleat about the "essential role of private capital" or the "need for the private sector" to be structured into all new policies for development in the global south countries.

By THAT what they mean is the governments must only be allowed to develop their essential infratructure (roads, water systems, electricity and energy systems, schools, medical facilities etc) by taking in debt from these western financiers, or by directly mandating them to be private monopolies owned by companies and banks and venture capital firms of the western financiers.

So rather than national debt, they are now structurally going to literally own and control the essentials of life in the global south. Hands on.

In doing so, basically there will be in effect, a tax on life and and all development in these countries, going directly into the pockets of the rich via their companies and the financial entities that they own and control.

These people are ghouls - vampires socking on the veins of everyone.

To be rich already and their children already rich guaranteed, is not enough for them. No - they also have to gurantee that the grandchildren and great grandchildren of everyone will already also now be guaranteed to be serfs of their rich descendants.

Its disgusting.