De-dollarization: China now uses yuan in over half of bilateral trade, dollar's share fell from 80% to under 50%

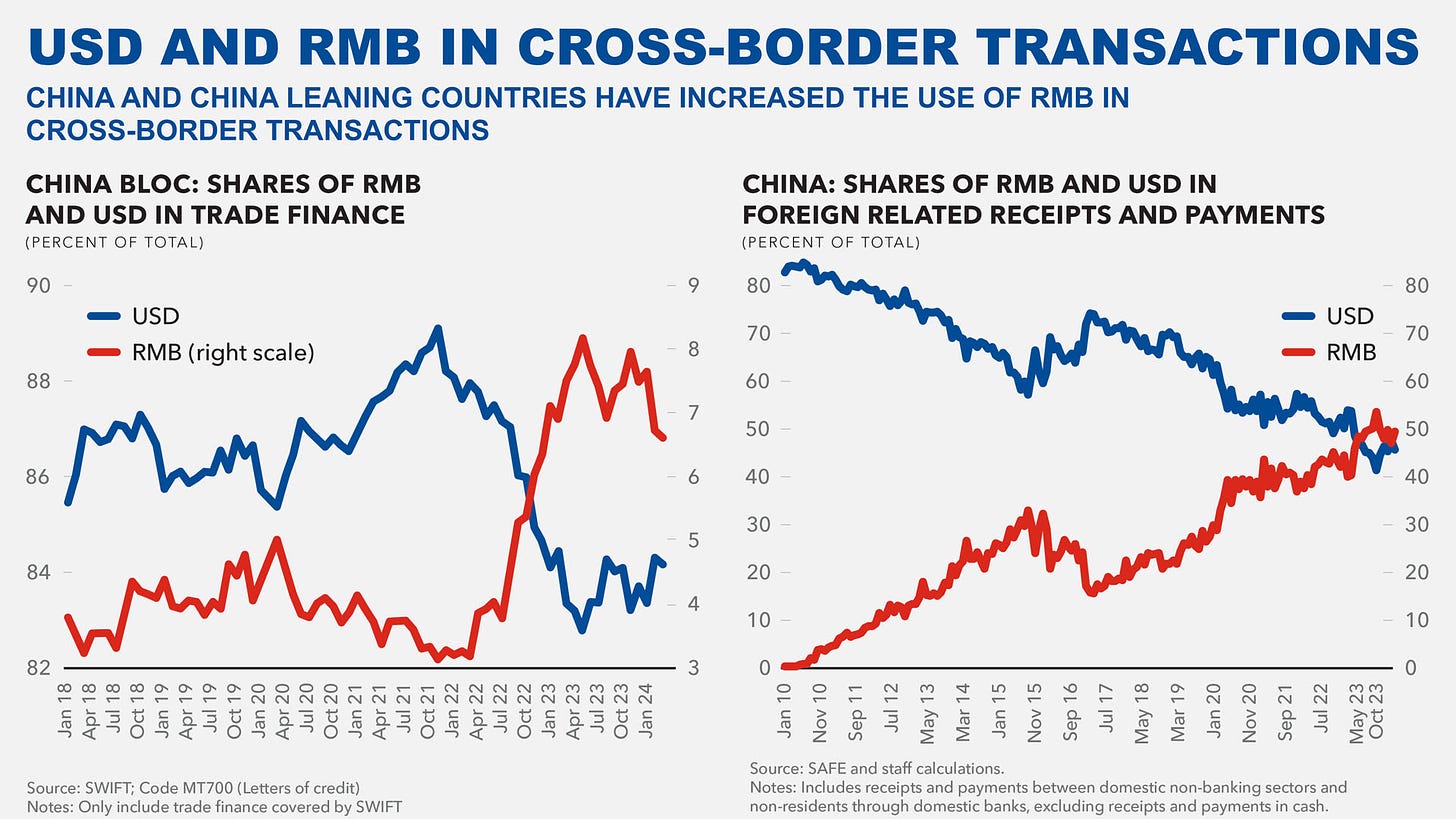

China is de-dollarizing rapidly. It now uses the renminbi (RMB or yuan) in just over half of cross-border transactions. The dollar's share of bilateral trade has fallen from 80% to less than 50%.

China is de-dollarizing its international trade at a rapid pace.

China now uses its own currency, the renminbi, in slightly over half of cross-border transactions. The US dollar's share of the country's bilateral trade has fallen to less than half.

The renminbi (RMB), which is also popularly known as the yuan, made up just over 50% of China's foreign receipts and payments in May 2023, according to data published by the International Monetary Fund (IMF).

This is a remarkable shift from 2010, when the RMB was basically not used in China's international trade.

In 2010, the US dollar's share of China's foreign receipts and payments was higher than 80%. In the next 13 years, it fell to below 50%.

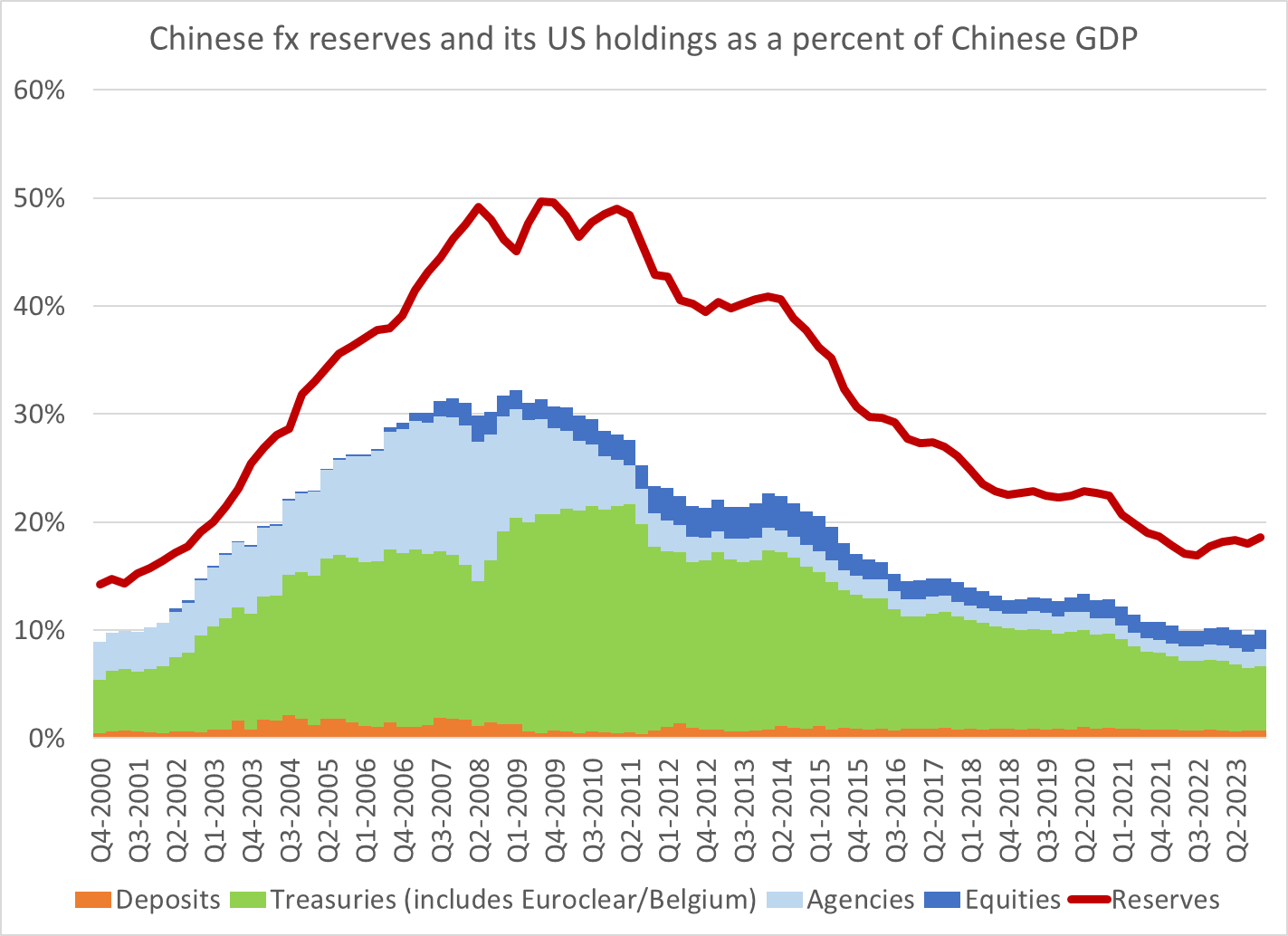

While de-dollarizing its bilateral trade, China has also gradually de-dollarized its savings.

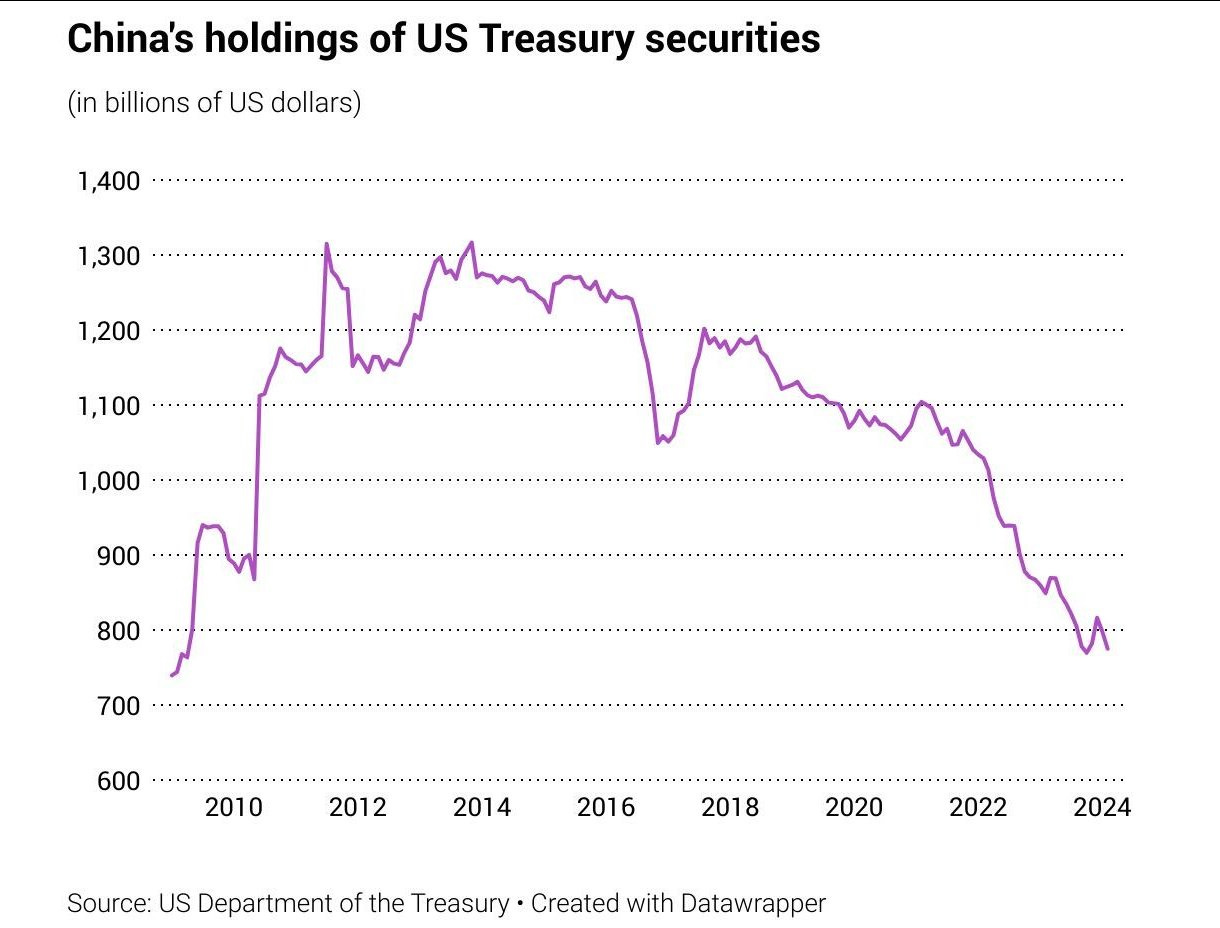

China's central bank, the People's Bank of China (PBOC), has steadily reduced its holdings of US Treasury securities over the past decade.

The PBOC's holdings of US Treasury securities peaked in 2014, at just over $1.3 trillion. They have declined significantly since then, reaching $767.4 billion in March 2024.

As a share of GDP, China's investment in US assets has dropped dramatically in the past two decades.

The PBOC's holdings not only of Treasury securities, but also US agency bonds and equities is at the lowest point, as a percentage of GDP, since China joined the World Trade Organization (WTO) in 2001.

As part of its de-dollarization drive, the PBOC is dumping US treasuries and instead buying gold.

Economists at JP Morgan, the largest US bank by assets, published a research paper on de-dollarization in 2023.

In reference to the global economy as a whole, they concluded that, "while marginal de-dollarization is expected, rapid de-dollarization is not on the cards".

However, they argued that, "Instead, partial de-dollarization — in which the renminbi assumes some of the current functions of the dollar among non-aligned countries and China’s trading partners — is more plausible, especially against a backdrop of strategic competition".

The JP Morgan economists added, "This could over time give rise to regionalism, creating distinct economic and financial spheres of influence in which different currencies and markets assume central roles".

One would never believe that a country that was able to attract countless smart people would be so idiotic that it foolishly used its own currency, with which it gained so much advantage, as a jerk stick against other nations, and now they whine that they don't want to use the dollar ! I think that dollars can only be accepted in the near future by those vassals who are forcibly kept "temporarily" in the hands of the USA ! However, the question must also be asked, when will a country that is so heavily indebted that its book value no longer covers the debt save ? Or does the USA imagine that no rules apply to it ?

USA fault. Countries sanctioned finding other ways of doing business