China's shocking DeepSeek AI pops US Big Tech monopoly bubble

Chinese AI company DeepSeek shocked the West with a groundbreaking open-source artificial intelligence model that beats huge Silicon Valley Big Tech monopolies. Is the US stock market bubble popping?

China is making enormous progress in the development of artificial intelligence technology, and it has set off a political and economic earthquake in the West.

The stocks of US Big Tech corporations crashed on January 27, losing hundreds of billions of dollars in market capitalization over the span of just a few hours, on the news that a small Chinese company called DeepSeek had created a new cutting-edge AI model, which was released for free to the public.

The UK's leading newspaper The Guardian described DeepSeek as “the biggest threat to Silicon Valley’s hegemony”.

This is widely being dubbed a “Sputnik moment” — a reference to 1957, during Cold War One, when the Soviet Union launched the first satellite in outer space, called Sputnik 1.

The United States had significantly underestimated the technological capabilities of the former Soviet Union then, just as the US has vastly underestimated the technological capabilities of China today.

What is remarkable is that this small Chinese company was able to develop a large language model (LLM) that is even better than those created by the US mega-corporation OpenAI, which is half owned by Microsoft, one of the biggest corporate monopolies on Earth.

In order to develop its groundbreaking R1 model, DeepSeek reportedly spent around $6 million.

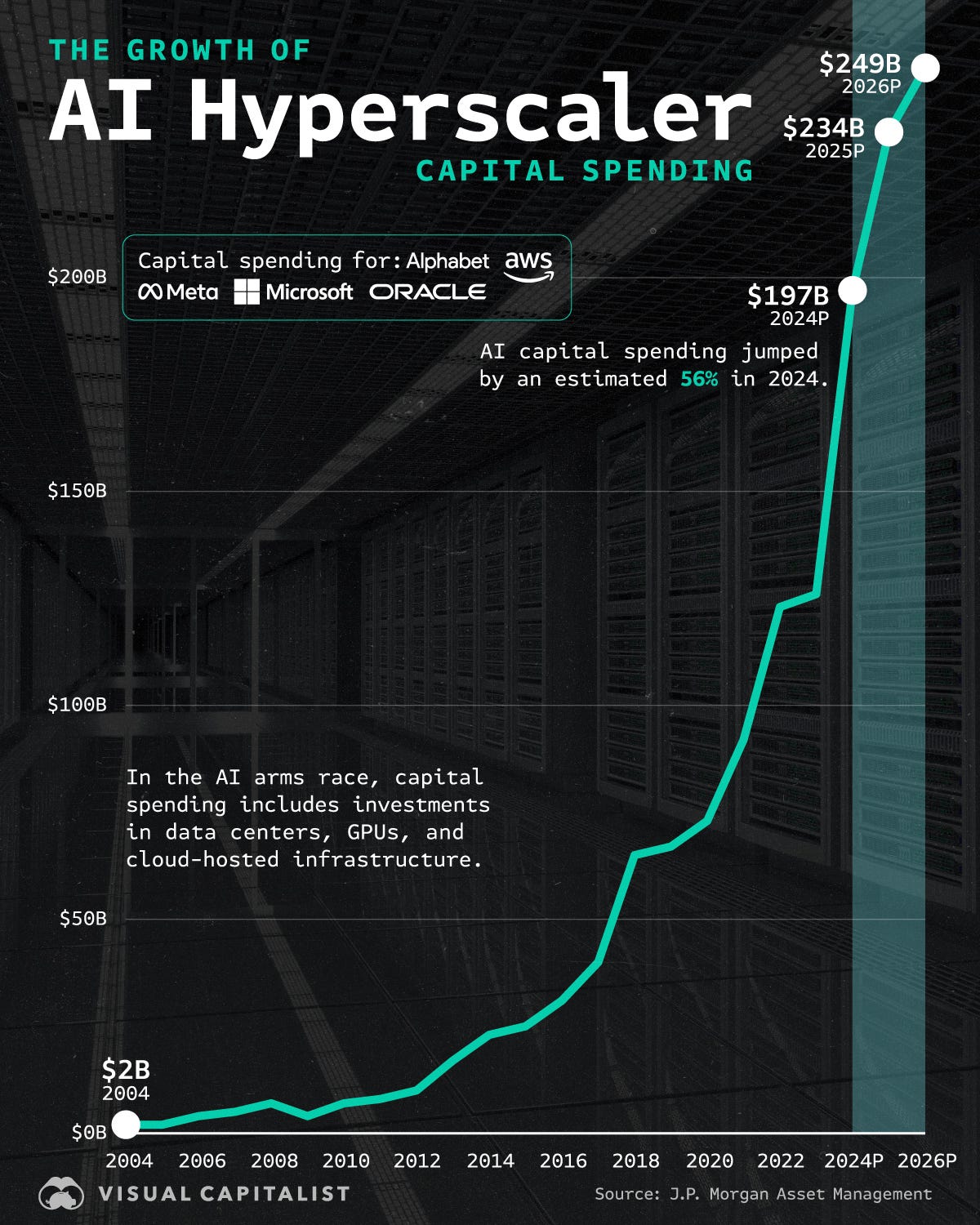

That would be a mere rounding error in Silicon Valley. US Big Tech corporations have plowed roughly $1 trillion into developing artificial intelligence in the past decade. In 2024 alone, Silicon Valley capital expenditure on AI was $197 billion, and it is expected to be $234 billion in 2025.

When OpenAI announced in December 2024 that it had introduced ChatGPT Pro, it was charging $200 per month to use the application.

Compare that to the DeepSeek R1 model, which is open source. Not only is their app free to use, but you can download the source code and run it locally on your computer. It can even be used without the internet.

Even better, DeepSeek’s LLM model only requires a tiny fraction of the overall energy and computing power needed by OpenAI’s models. In short, it is cheaper to run, better for the environment, and accessible to the entire world.

This is why the week it was launched, in late January, DeepSeek became the number one app in the United States, overtaking ChatGPT.

Alarm bells immediately sounded in Washington. US officials claimed the app is a supposed “national security” threat — their favorite excuse to justify imposing restrictions on Silicon Valley’s Chinese competitors.

The US Navy promptly banned DeepSeek, citing “potential security and ethical concerns”.

Starting in Donald Trump’s first term, and continuing through the Joe Biden administration, the US government has waged a brutal technology war and economic war against China.

Washington hit China with sanctions, tariffs, and semiconductor restrictions, seeking to block its principal geopolitical rival from getting access to top-of-the-line Nvidia chips that are needed for AI research — or at least that they thought were needed.

DeepSeek has shown that the most cutting edge chips are not necessary if you have clever researchers who are motivated to innovate.

This realization unleashed pandemonium in the US stock market.

In just one day, Nvidia shares fell 17%, losing $600 billion in market cap. This was the largest one-day drop in the history of the US stock market.

This was a blow to global investor confidence in the US equity market and the idea of so-called “American exceptionalism”, which has been consistently pushed by the Western financial press.

Some financial analysts are now publicly wondering if this could be the beginning of the popping of the massive bubble in the US stock market.

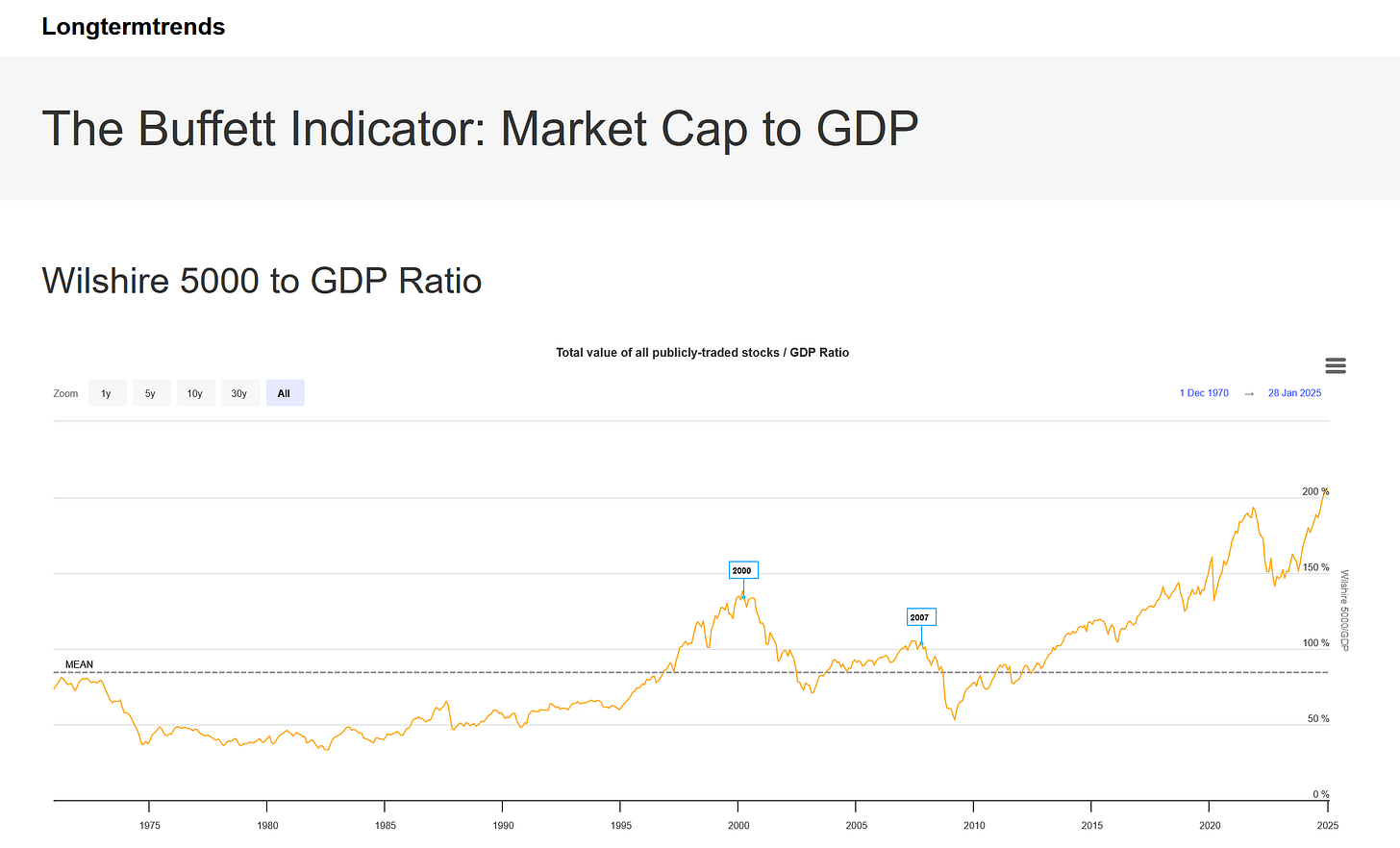

A look at the Buffett Indicator, which measures the market capitalization of publicly traded stocks in the US in comparison to GDP, shows that it is at the highest level ever recorded, at more than 200% of GDP. This is significantly higher than it was at the peak of the Dot-com bubble, which burst in 2000.

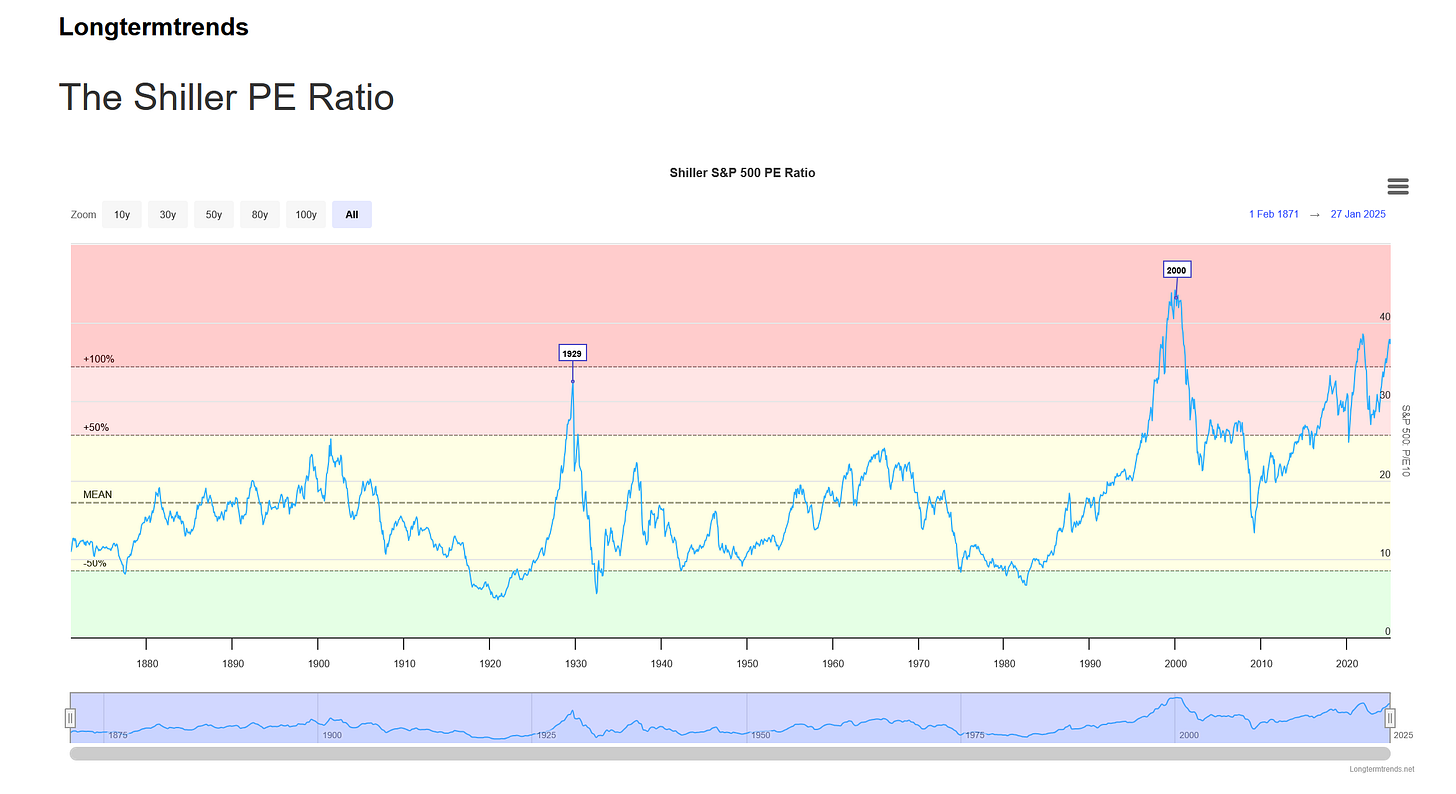

Another common metric, the price-to-earnings ratio, or P/E ratio, which compares the inflation-adjusted earnings of US publicly traded companies to the price of their stocks, similarly demonstrates that they are very frothy -- at the highest levels since the Dot-com bubble, and even higher than they were in 1929, at the peak of the stock market mania which crashed and contributed to the Great Depression of the 1930s.

This is why even Jamie Dimon, the CEO of the largest US bank, JPMorgan Chase, warned at the World Economic Forum in Davos in January that the US stock market is “inflated”.

What is even more concerning is how extremely concentrated the US equity market is.

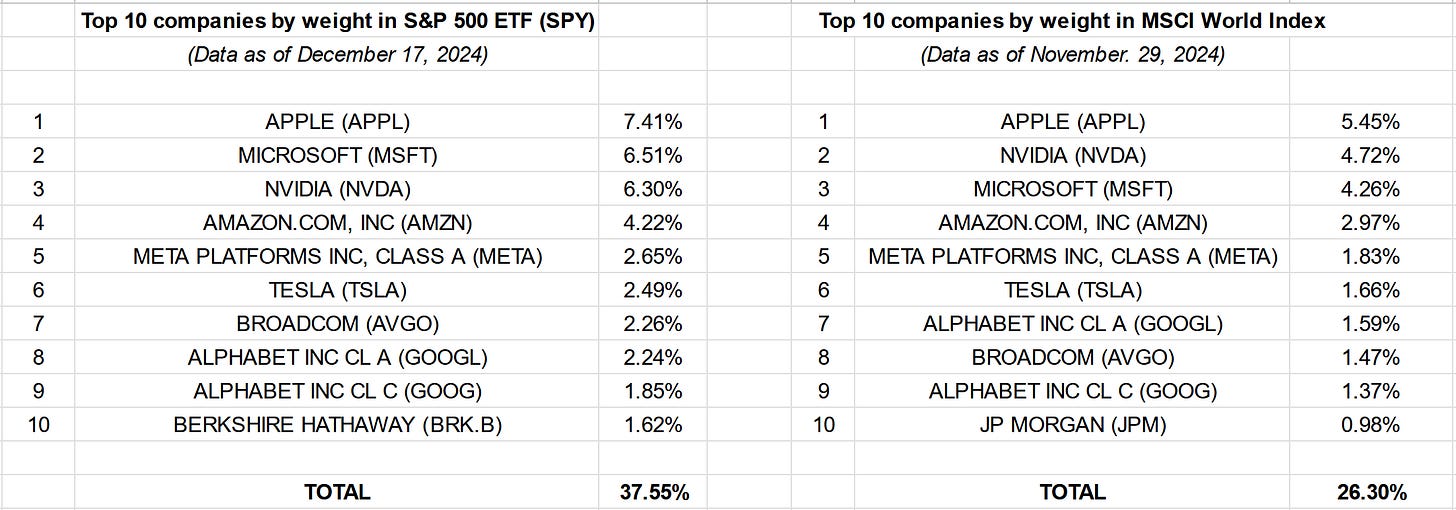

Much of the growth in recent years in the S&P 500, the index of the 500 largest publicly traded companies on US stock exchanges, has been driven by a small handful of Big Tech corporations, which are known as the Magnificent 7, or the Mag7. These are Apple, Microsoft, Nvidia, Amazon, Meta, Tesla, and Alphabet.

Together, those seven Big Tech corporations made up a third of the weight of the entire S&P 500, as of December 2024.

Moreover, those same seven companies made up nearly a quarter of the weight of the MSCI World Index.

There are trillions of dollars from investors all around the world that have flooded into the stocks of these US Big Tech monopolies under the assumption that they have no real competition, that they're the only game in town.

However, China has shown that there are competitors, and they are challenging the technological chokehold that Silicon Valley has on most of the world.

Given how much the US economy has been financialized in the neoliberal era, and how much depends on continuing to inflate asset prices, a crisis could be on the horizon if the AI bubble pops.

As always, Ben Norton, thank you for your scholarly insights.

Txs guys for your info.

But today Sam Altman of OpenAi is saying that Chinese have stolen trained data from ChapGPT... Ha, ha, ha.... whatever is true or not, good job Chinese!! Keep pushing, keep crushing all of those warmonger companies that are supporting and helping Israel to commit more and more atrocities with AI!! And I'm pointing specifically at Micropork, and Nazi Scroogle.

GO CHINA GOI!!!