Billionaire Vivek Ramaswamy is a Wall Street speculator accused of pump-and-dump schemes, not a scientist

While he misleadingly presents himself as a "scientist", billionaire DOGE co-chair Vivek Ramaswamy is just another Martin Shkreli-style Wall Street speculator accused of running pump-and-dump schemes.

Vivek Ramaswamy is the billionaire Republican politician and failed presidential candidate whom Donald Trump appointed to lead the so-called "Department of Government Efficiency" (DOGE), alongside co-chair Elon Musk, the richest oligarch on Earth (who brands himself a libertarian anti-government crusader, while his companies receive billions in US government subsidies).

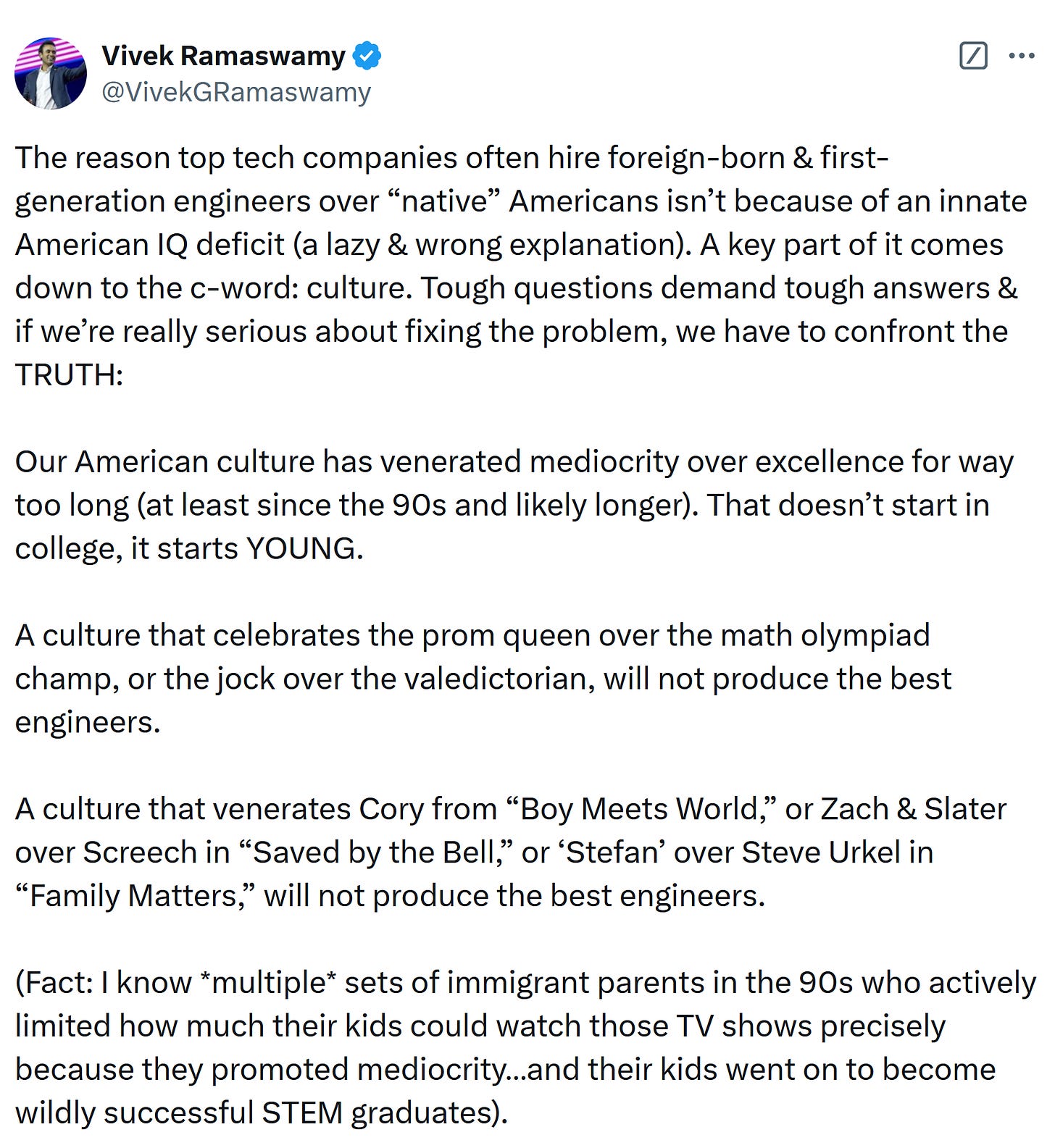

Ramaswamy sparked something of a civil war among US conservatives with a puerile Twitter post lamenting how US popular culture upholds jocks over nerds.

Way too much digital ink has been spilled over this petty rant, but I wanted to throw in my two cents and make a point I haven't seen emphasized enough: Although he loves to bloviate about engineers and scientists, Ramaswamy is in reality a Wall Street finance bro!

He did briefly study biology as an undergraduate student at Harvard, but he worked for hedge funds and Goldman Sachs, and went to Yale Law School with JD Vance (another pseudo-“populist” who got rich working for billionaire-backed venture capital funds).

Vivek Ramaswamy is not an engineer or a scientist.

While he criticizes superficial US culture, Ramaswamy is the embodiment of the superficial Wall Street speculators who make billions, yet produce nothing for society; they just move capital around.

When Ramaswamy founded his so-called "biotechnology" company Roivant "Sciences", he didn't really develop biotech. It started as a financial firm. Forbes described it as an “investment holding company”.

Ramaswamy’s strategy was to buy patents from other pharmaceutical companies that actually developed drugs, to bring those drugs that real scientists created to the market, and to get rich off of capital gains, not innovation.

Although he did indeed make a lot of money doing this, Ramaswamy was not very successful at marketizing drugs that truly helped people. As Forbes reported:

[Ramaswamy’s] thesis: Pharma giants had plenty of abandoned drugs that could be worth a fortune if someone focused on them. One year after founding the company [Roivant Sciences], one of Roivant’s spinoffs, named Axovant, went public at a $2.2 billion valuation. Its prized asset: a much-hyped Alzheimer’s drug candidate, Intepirdine, which Ramaswamy had purchased for just $5 million. The year that Axovant joined the New York Stock Exchange, Ramaswamy reported more than $38 million of income, most of it from capital gains, on his tax return.

Intepirdine turned out to be a disappointment, failing a clinical trial two years later.

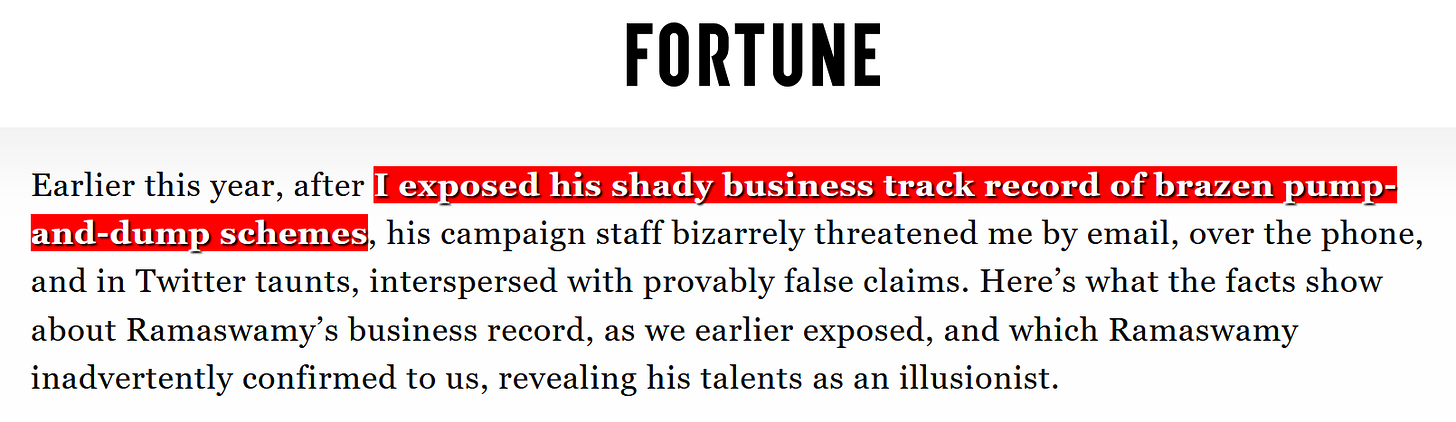

This is why Jeffrey Sonnenfeld — practically a figure of royalty in the US corporate world, who founded Yale’s Chief Executive Leadership Institute and has advised a Who’s Who of powerful CEOs — described Ramaswamy as an “entrepreneurial huckster” with a “shady business track record of brazen pump-and-dump schemes”.

Given his impeccable corporate bona fides, Sonnenfeld’s exposé on Ramaswamy is devastating, and should be read in full. But this is the most relevant passage:

Ramaswamy’s tax records show that the first time he ever made big money was when he hyped up an Alzheimer’s drug candidate, Axovant, which had been discarded by other pharmaceutical companies. Axovant, which was 78% owned by Ramaswamy’s corporate holding company Roivant, blew up after failing FDA tests, with the stock crashing from $200 to 40 cents, fleecing thousands of mom-and-pop investors who bought into the hype. Ramaswamy himself profited handsomely (even if the Ramaswamy campaign took a while to acknowledge the truth).

Ramaswamy spokesperson Tricia McLaughlin first told us that “the idea that Vivek made any money on [Axovant’s] failure is a total lie” before finally acknowledging that Ramaswamy did indeed cash out, claiming “[Ramaswamy] and other shareholders were forced to sell a tiny portion of their shares in 2015 to facilitate an outside investor entering Roivant.” The facts are that Ramaswamy’s own tax returns show he opportunely sold out of nearly $40 million of Roivant stock right as Axovant’s hype was peaking. Meanwhile, Roivant was raising $500 million driven largely by Axovant. As Ramaswamy was busy selling his own personal stake, Roivant gradually reduced and diluted its Axovant stake from 78% to just 25%.

Clearly, the facts show Ramaswamy’s words did not match his actions as he was busy cashing out while shamelessly hyping Axovant’s prospects in media interviews–almost resembling a classic pump-and-dump scheme. Some $40 million in personal windfalls is hardly “tiny.” Ramaswamy was not “forced to sell” as that was clearly a personal choice without anyone holding a gun to his head. Amazingly, Ramaswamy’s spokesperson further confirmed to us that Ramaswamy was aware that 99.7% of all drugs tested for Alzheimer’s fail even though he was relentlessly hyping Axovant’s chances of success with nary a mention of that inconvenient truth.

Hilariously, Ramaswamy also received a fellowship from billionaire oligarch George Soros, the bugbear of the US right, and paid a Wikipedia editor to try to excise this information from his page on the online encyclopedia.

In the same vein, Sonnenfeld noted that Ramaswamy is an “opportunistic, dual Ivy-Leaguer with well-educated professional parents [who] was so desperate to be recast as a populist that he sued the Davos World Economic Forum to purge him from the participant lists”.

The fact is that, while he sometimes misleadingly presents himself as a "scientist", Vivek Ramaswamy is just another parasitic Wall Street speculator — albeit a bit better at PR than his erstwhile business partner and friend Martin Shkreli (the infamous “pharma bro” who made bank by price gouging on life-saving drugs).

It is also deeply ironic that Ramaswamy feigns concern about the sad state of scientific education in the United States while he actively calls for abolishing the Department of Education. Who is going to educate the future generations of engineers and scientists? If the DOGE of Ramaswamy and Musk gets its way, only the elite children of rich parents will be able to afford high-quality education, at expensive private schools in the US. (I guess everyone else could study abroad, where foreign governments actually prioritize funding high-quality public education -- rather than plowing trillions of dollars into waging nonstop wars and maintaining a global empire with nearly 800 foreign military bases.)

While Ramaswamy always prefers to distract from US social ills by fueling more culture war (or scapegoating China), the actual problem in US society is that the smartest people are heavily financially incentivized to go to law school; work at hedge funds, investment banks, and private equity firms; and become Wall Street speculators, instead of scientists and engineers. Countless PhDs in physics, engineering, and mathematics abandon their research to do glorified gambling as quants.

Their job is to make rich oligarchs even richer, not to innovate and make average people's lives better.

Vivek Ramaswamy should know; that's his life story.

He’s also a climate change denier and thinks that America needs fossil fuels

And decades of wasting talent - not educating Black and poor people - in under resourced schools and then sending them more often to prison - often for same offences rich people do not go to prison for - is a big part of why we have failed education system.