Elite US economist warns: dollar system is weakening as gold BRICS rise

The US dollar is losing its dominance, and foreign central banks are buying fewer Treasury securities, instead holding more gold in their reserves, warns mainstream American economist Mohamed El-Erian

More and more countries around the world, particularly in the Global South, are seeking alternatives to the US dollar-dominated financial system, as part of an international drive known as de-dollarization.

Many Western media outlets and pundits, however, have argued that de-dollarization is overblown.

One of such naysayers is New York Times columnist Paul Krugman, a centrist economist who was awarded the so-called "Nobel Prize" in economics (which in reality is issued by Sweden's conservative central bank).

In a 2023 article, Krugman claimed to "debunk" the critics of the dollar system, asserting that "the hype about de-dollarization is much ado about almost nothing".

This narrative has been echoed by media outlets like Business Insider, which insisted "dollar dominance isn't going anywhere"; or Foreign Policy magazine, which invited the head of the Goldman Sachs Global Institute to argue that "there isn’t a real global alternative" to the dollar system.

Nevertheless, there are growing cracks in this elite consensus. The mainstream American economist Mohamed El-Erian, a former deputy director of the US-dominated International Monetary Fund (IMF), has warned that de-dollarization is indeed happening.

In a column in the Financial Times, El-Erian acknowledged that the US dollar is gradually losing its dominance, as foreign central banks buy fewer Treasury securities, instead holding more gold in their reserves.

El-Erian is by no means an outsider in the West's neoliberal establishment. In fact, President Barack Obama previously appointed him as chair of the US Global Development Council, and today he serves as president of Cambridge University's prestigious Queens’ College.

With this op-ed in the FT, El-Erian was urging his colleagues to show a bit more caution - and to take their heads out of the dogmatic sands of neoclassical economic orthodoxy.

The price of gold "seems to have decoupled from its traditional historical influencers, such as interest rates, inflation and the dollar", El-Erian observed.

Given that gold is an inflation hedge, gold's price tends to be positively correlated with inflation. But as inflation has fallen in the past year, gold has ascended to record highs, rising 40% in the previous 12 months.

One of the main reasons for this is that the central banks of many Global South nations are purchasing huge sums of gold - especially China and what El-Erian described as “middle power” countries, which have united in and around BRICS.

A growing number of countries want to "gradually diversify their reserve holdings away from significant dollar dominance despite America’s 'economic exceptionalism'", El-Erian acknowledged, and these nations have an "interest in exploring possible alternatives to the dollar-based payments system that has been at the core of the international architecture for some 80 years".

Why is this happening? El-Erian conceded that it is due to "America’s weaponisation of trade tariffs and investment sanctions, together with its reduced interest in the rule-based, co-operative multilateral system that it played a pivotal role in designing 80 years ago".

He, too, lamented that Washington's staunch support for Israel in its genocidal war on Gaza, invasion of Lebanon, and attacks on other countries in West Asia has caused many nations to see the US "as an inconsistent backer of both fundamental human rights and the application of international law".

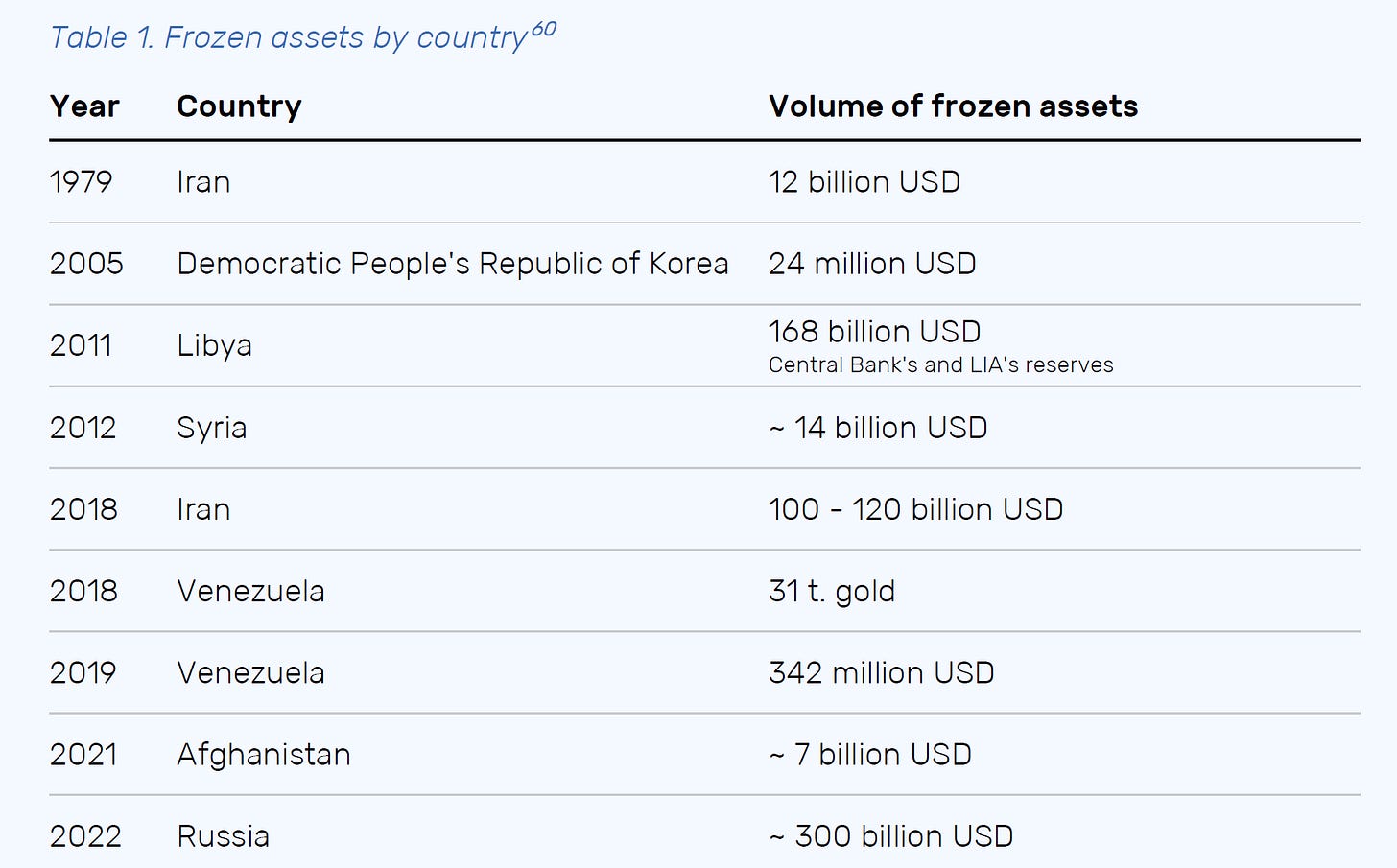

There is also the fact that North America and Europe have seized hundreds of billions of dollars worth of assets from the reserves of Russia (and Iran, Venezuela, Syria, Afghanistan, and North Korea). Many countries are now afraid they could be the next victims.

Although El-Erian didn't state this clearly, it was understood in the context of his remarks.

Another word conspicuously absent from El-Erian's article was BRICS. But he was obviously alluding to it. It's noteworthy that his column was published the week that Russia hosted a historic BRICS summit in the city of Kazan.

Geopolitical Economy Report has detailed BRICS' plans to create a "multi-currency system" to challenge the dominance of the US dollar.

In his Financial Times op-ed, El-Erian obliquely admitted that the economic war that North America and Europe have waged on Russia has failed.

After the West disconnected Russian financial institutions from the Swift interbank messaging system, Moscow created "a clunky trade and payments alternative system that involves a handful of other countries", El-Erian noted, which has "allowed Russia to bypass the dollar and maintain a core set of international economic and financial relations".

He warned that "an increasing number of little pipes are being built to go around this [US dollar] core; and a growing number of countries are interested and increasingly involved", and this "risks materially fragmenting the global system and eroding the international influence of the dollar and the US financial system".

One other significant factor left out of El-Erian's (admittedly short) article was the US Treasury market.

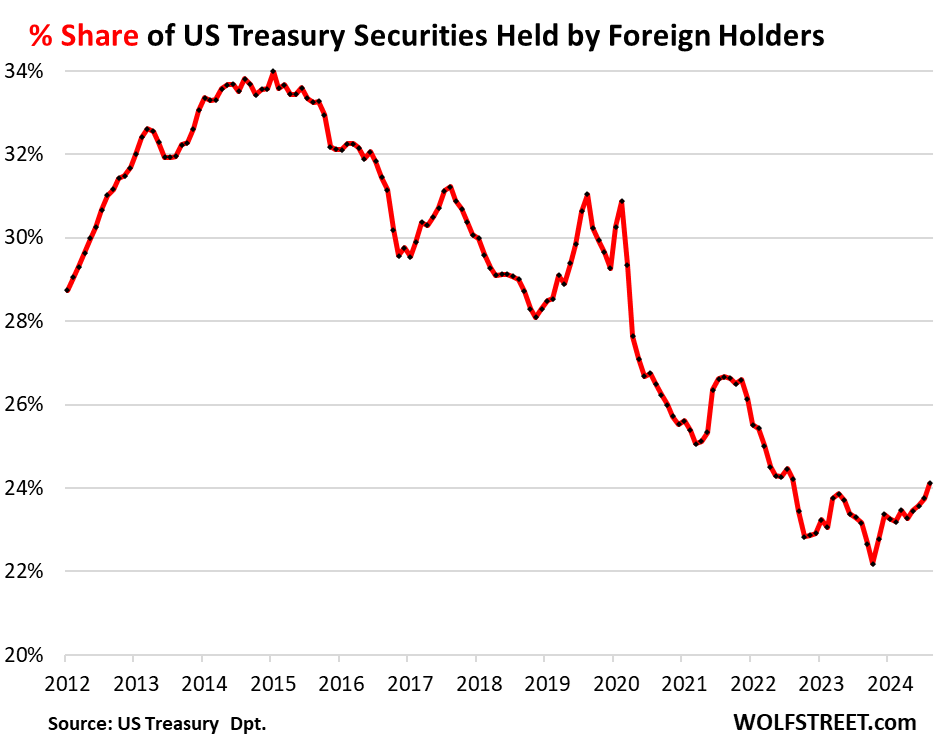

The share of US Treasury securities held by foreign investors peaked in 2015, at around 34%, and has steadily fallen in the past decade to 23-24% in 2024.

Meanwhile, US federal debt as percentage of GDP is at over 120%, and keeps ballooning, with annual deficits at more than 6% of GDP.

Both Donald Trump and Kamala Harris would only continue this trend.

There is simply less demand for a growing number of US Treasuries (even though investors in Europe, the UK, Canada, Taiwan, and India are helping Washington try to keep yields manageable).

At some point, Washington will have to decide which is more important: keeping consumer price inflation low, or keeping Treasury yields low. Following the Fed's rate hikes of 2022-2023, US interest payments on federal debt exceeded the gargantuan military budget.

It is not just geopolitics driving de-dollarization, therefore, but also US monetary and fiscal policy.

This may partially explain why, when the Federal Reserve reduced interest rates by 50 basis points in September, the yield on the 10-year Treasury note went up, not down. Demand for Treasury securities is evidently not as strong as US policymakers would like - especially foreign demand.

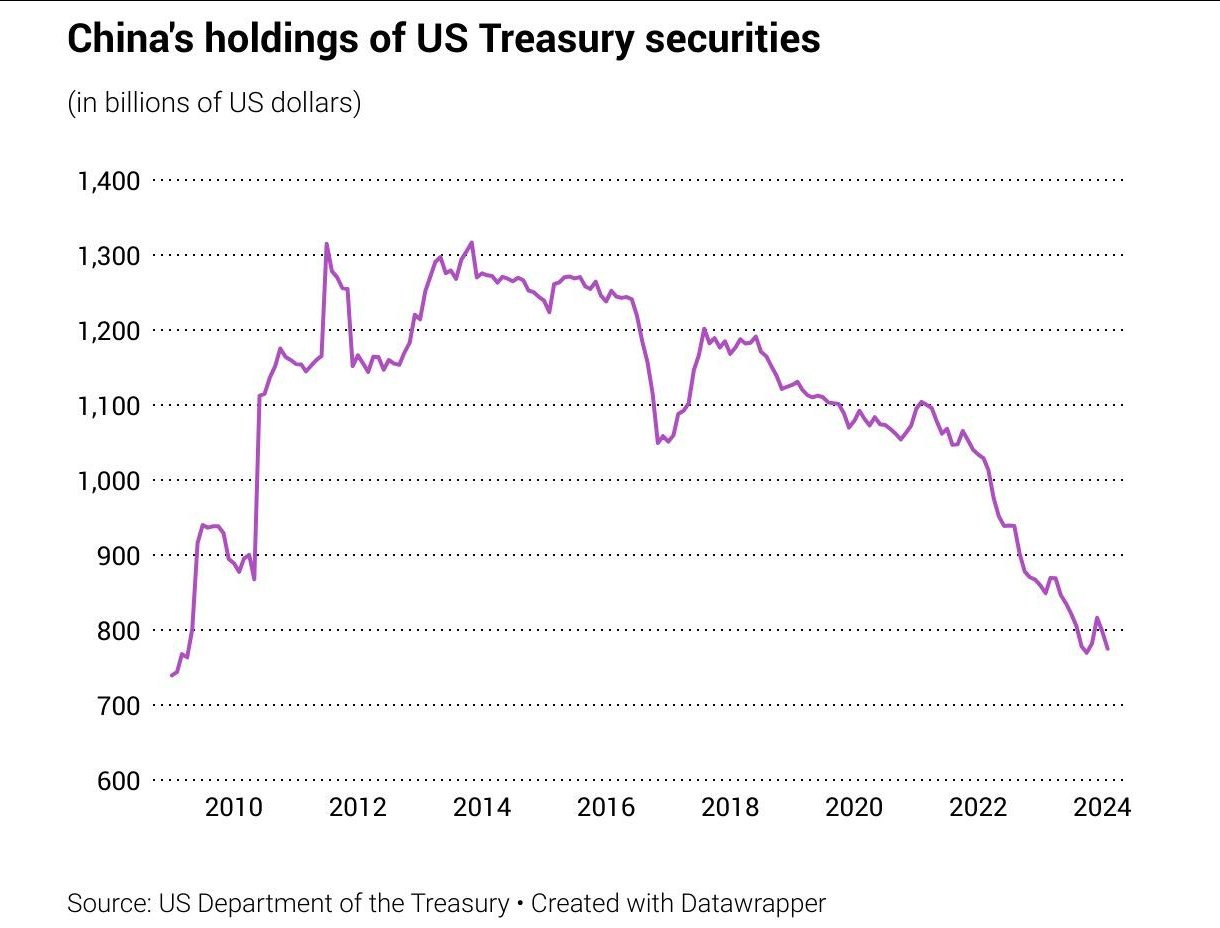

The move away from US Treasuries is especially clear when one looks at the reserves of the People's Bank of China.

Beijing's holdings of US Treasury securities have consistently fallen since 2014, from more than $1.3 trillion to less than $800 billion as of 2024.

That said, regardless of El-Erian's omissions, what is significant is that, in an article in the world's leading financial newspaper, this elite US economist acknowledged that many of the critics of the dollar system are correct.

The New York Times, Paul Krugman, and many of the elites in the US press and academia may still be in denial, but a few of their colleagues are waking up to the reality.

Meanwhile, Western media outlets like the state-backed France24 want the world to believe that "the BRICS nations failed to rebuild the global financial order", but the fact is they are just getting started.

A freshening reality is upon us.

Nice to read about it.

I've shared your recent comments and videos. I'm not sure, maybe including the one featured in this essay, I have to study it. This is very well done thank you. Here is a recent substack that I published concerning Michael Hudson. I've learned more from Michael Hudson in the last couple decades than anyone else I encountered. https://open.substack.com/pub/heininger/p/michael-hudson-in-praise-of-and-for?utm_source=share&utm_medium=android&r=16lm0