Geopolitical game changer: China's Iran-Saudi peace deal is big blow to petrodollar and US economic hegemony

China’s peace deal between Saudi Arabia and Iran is a big blow to the petrodollar that undergirds US economic hegemony. Both major oil producers that are discussing selling energy in other currencies.

China surprised the world on March 10, announcing that it had successfully sponsored peace talks between rivals Saudi Arabia and Iran.

Four days of secret negotiations in Beijing led to a historic agreement in which the two West Asian nations normalized relations, following seven tense years without any official diplomatic ties.

Iraq had previously hosted peace talks between Saudi Arabia and Iran, but these were sabotaged in January 2020 when US President Donald Trump ordered a drone strike to assassinate top Iranian official Qasem Soleimani, who had been involved in the negotiations.

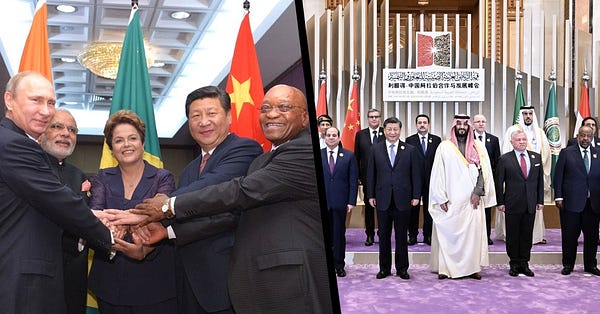

China's diplomatic breakthrough is part of a larger process of Asian integration, and constitutes a step toward bringing both Iran and Saudi Arabia into the BRICS system and institutions like the Shanghai Cooperation Organization.

In addition to encouraging stability and peace in a region that has been devasted by decades of US wars and meddling, this deal will have huge economic repercussions across the planet.

More tangibly, the agreement is a significant blow to the petrodollar system that the United States has used to maintain the dollar as the global reserve currency, thus threatening the very foundation of its economic hegemony.

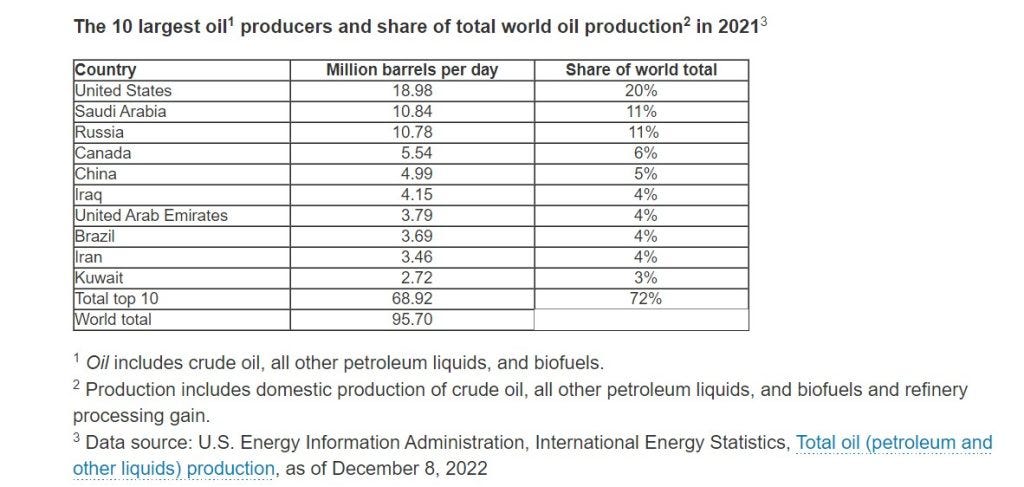

Saudi Arabia has long been one of the world's leading producers of oil, in the top three (along with the US and Russia). Iran has consistently been among the top 10 producers of crude.

As de facto leader of OPEC, Saudi Arabia has significant influence over the price of oil on the global market. Since the 1970s, Riyadh has agreed to sell its crude in dollars and then invest those petrodollars in Treasury securities, helping to strengthen the value of the greenback and increasing global demand for the US currency.

But the petrodollar system is facing new challengers. The Saudi government publicly confirmed in January that it is considering selling oil in other currencies.

This declaration came just a few weeks after Chinese President Xi Jinping took a historic trip to Riyadh. There, Beijing signed agreements with the Gulf Cooperation Council (GCC) and Arab League.

Xi announced that China would be buying oil and gas from the Persian Gulf region with its own currency, the renminbi, not dollars.

"China will continue to import large quantities of crude oil from GCC countries, expand imports of liquefied natural gas ... and make full use of the Shanghai Petroleum and Natural Gas Exchange as a platform to carry out yuan settlement of oil and gas trade", he said.

Xi's trip to Riyadh was a resounding success when compared to Joe Biden's attempt at a "reset" in July 2022. A photo of the US president refusing to shake hands and instead fist-bumping with the de facto Saudi ruler, Crown Prince Mohammad bin Salman (MBS), was a symbol of a trip that was widely panned as a diplomatic failure.

At the time, Biden had been struggling with significant consumer price index inflation at home, with midterm elections on the horizon. The US president pressured MBS to increase oil production in an attempt to bring down prices. But Saudi Arabia and OPEC+ refused to do so.

Riyadh's gradual move away from its historical role, firmly ensconced in the heart of the US-led camp, reflects a larger global trend toward a multipolar world.

Saudi Arabia and other Persian Gulf states are adopting a more non-aligned foreign policy that balances the US and Europe against China and Russia.

This also is a result of China's growing economic importance, as the biggest economy in the world (according to a purchasing power parity measurement, which is more accurate than nominal GDP).

China is the largest trading partner of both Saudi Arabia and Iran. Beijing enjoys close relations with the West Asian nations.

In its readout announcing the peace deal, China's Foreign Ministry described itself as "a reliable friend of the two countries".

Iran and Saudi Arabia have formally applied to join the extended BRICS+ bloc, alongside founders Brazil, Russia, India, China, and South Africa.

BRICS is currently planning to “develop a fairer system of monetary exchange”, to weaken the “dominance of the dollar”, South Africa’s Foreign Minister Naledi Pandor revealed in January.

As part of this process, BRICS is considering creating a new international reserve currency, based on a basket of currencies of its members.

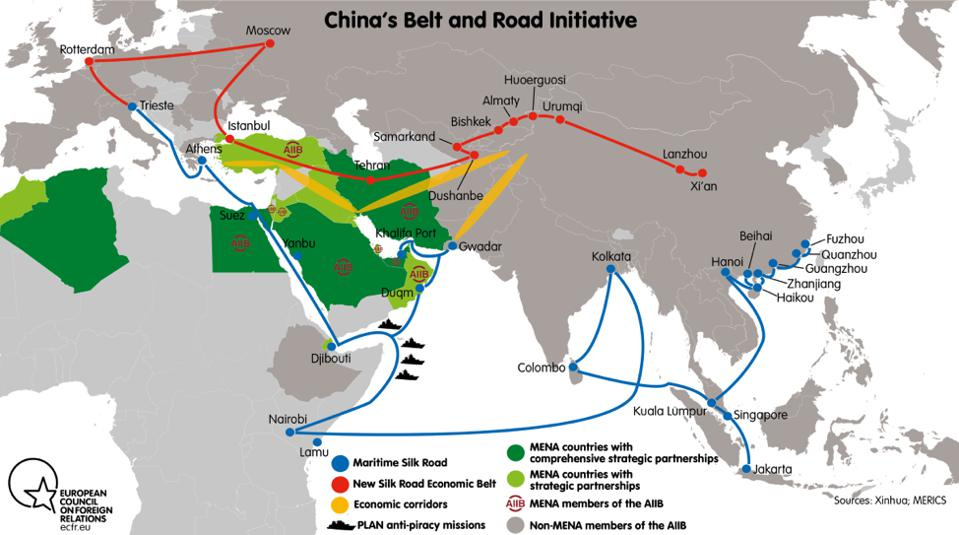

As BRICS seeks to economically integrate the Global South, China's massive Belt and Road Initiative (BRI) will provide the physical infrastructure to do so. And both Iran and Saudi Arabia are also important parts of the BRI.

Complementing the BRICS system is the Shanghai Cooperation Organization (SCO), which brings together China, India, Pakistan, Russia, and numerous Central Asian republics in a massive association representing around two-fifths of the global population and more than one-third of the world's GDP.

Iran is in the process of becoming a full member of SCO. The organization's Secretary-General Zhang Ming visited Tehran in March. He met with Iranian President Ebrahim Raisi, who "described the SCO as the world’s largest regional international organisation that plays an important role in maintaining regional and global security and stability".

In 2021, Saudi Arabia became an official SCO dialogue partner, in a step toward membership. Qatar and Egypt did the same in 2022.

BRICS+: a global commodities powerhouse

If all of these countries can be economically and politically integrated, the extended BRICS+ bloc would be the world's commodities powerhouse.

BRICS founding members Russia, China, and Brazil are among the top 10 biggest producers of oil in the world, along with Saudi Arabia and Iran.

If the West Asian nations officially join, BRICS+ will include at least half of the world's top 10 oil producers, representing more than one-third of global petroleum output.

OPEC, too, would become a natural partner of BRICS, given Saudi Arabia's key role in the organization, along with Russia's influential voice in the extended OPEC+.

It is not just oil that is central in this geopolitical shift. Gas and other commodities are crucial as well.

Russia is the world's second-largest producer of natural gas. Iran is the third biggest, China is the fourth, and Qatar is fifth.

Algeria, which has also expressed interest in joining BRICS+, is a major gas producer.

Qatar is tied with the United States as the biggest producer of liquified natural gas (LNG) on Earth. Algeria is in the top 10.

This alliance is deeply complementary. China is the world's largest consumer of oil, and one of the biggest importers of gas.

Already for over a decade, China has bought more oil from West Asia than has the United States. Beijing imports one-third of its energy resources specifically from the Persian Gulf region.

And as the planet transitions away from fossil fuels and toward renewable energy technologies, minerals will become increasingly important. BRICS-curious countries are very well placed here as well.

Brazil is the second-biggest producer of iron ore, followed by fellow BRICS members China, India, Russia, and South Africa in third, fourth, fifth, and seventh place, respectively. Potential BRICS member Iran is the eighth largest.

China and Brazil are top producers of lithium, the "white gold" needed for batteries. So, too, is Argentina, which has applied to join BRICS+, and virtually attended the bloc's summits in 2022.

Iran announced this March that it also found significant lithium reserves, which could be the second biggest in the world.

What all of this shows is that, by extending and including countries like Saudi Arabia and Iran as new members, BRICS+ could become a commodities powerhouse, with significant influence in global markets.

None of this would have been possible if Saudi Arabia and Iran were at war with each other. Now that they have normalized relations, Asian integration is likely to move forward, full steam ahead.

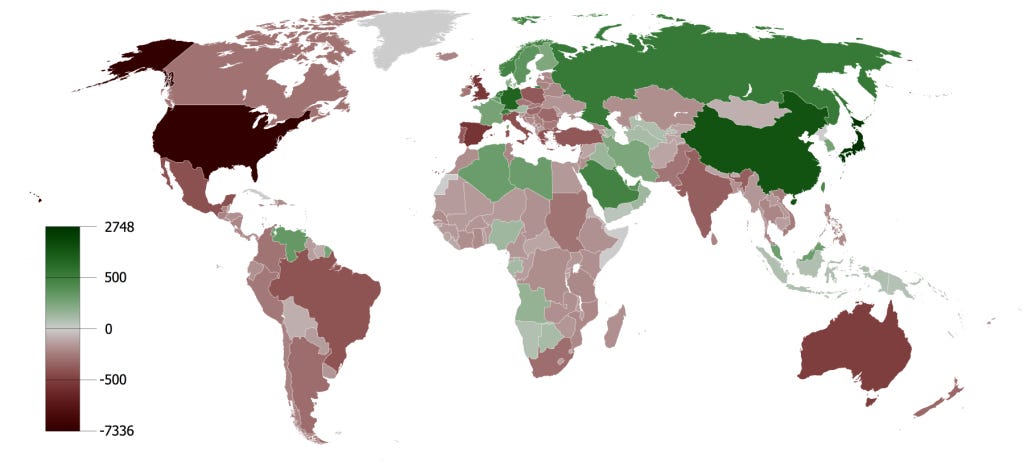

[caption id="attachment_9478" align="aligncenter" width="880"]

Countries by their current account balance (red is a deficit, green is a surplus)[/caption]

Has the petrodollar met its match?

The Bretton Woods Conference in 1944 established the US dollar as the global reserve currency. At that time, the dollar was pegged to gold at the price of $35 per troy ounce, making it essentially as good as gold.

US military spending in its wars on Korea, Vietnam, and beyond led Washington's gold reserves to run low. So in 1971, President Richard Nixon unilaterally ended the convertibility of the dollar into gold, making the greenback a freely floating fiat currency.

This led to a period of instability, which was further compounded by OPEC's 1973 oil embargo.

In 1974, Nixon sent his Treasury secretary, William Simon, to Saudi Arabia. "The goal" of the trip, Bloomberg explained, was to "neutralize crude oil as an economic weapon and find a way to persuade" Saudi Arabia "to finance America’s widening deficit with its newfound petrodollar wealth".

Washington signed a historic agreement with Riyadh, pledging to protect the Gulf monarchy in return for Saudi Arabia selling its oil exclusively in dollars, depositing those petrodollars in US commercial banks, and investing in Treasury bonds.

Bloomberg explained: "The basic framework was strikingly simple. The U.S. would buy oil from Saudi Arabia and provide the kingdom military aid and equipment. In return, the Saudis would plow billions of their petrodollar revenue back into Treasuries and finance America’s spending".

This petrodollar system helped ensure global demand for the dollar, because countries that imported oil and other commodities needed dollars to pay for them.

As economist Michael Hudson showed in his book Super Imperialism, the ballooning US current account deficit was almost entirely from military spending, as Washington waged war after war and built a constellation of foreign bases across the globe.

For most countries, such a consistent, long-term deficit would lead to a devaluation of their national currency and related economic problems. But not for the US, thanks in part to the petrodollar system.

The status of the dollar as global reserve currency and the steady demand for dollars to import oil and other commodities granted the United States an "exorbitant privilege" that has allowed it to maintain this massive current account deficit (importing significantly more than it exports).

The 2008 financial crash, however, inspired some countries to think about alternatives. China, specifically, floated the idea of unseating the US dollar as the global reserve currency.

The governor of China's central bank, Zhou Xiaochuan, published a white paper in 2009, arguing that the "crisis again calls for creative reform of the existing international monetary system towards an international reserve currency with a stable value, rule-based issuance and manageable supply, so as to achieve the objective of safeguarding global economic and financial stability".

Ever escalating Western sanctions on China and allies such as Russia, Iran, and Venezuela have only further incentivized Beijing to seek new financial alternatives.

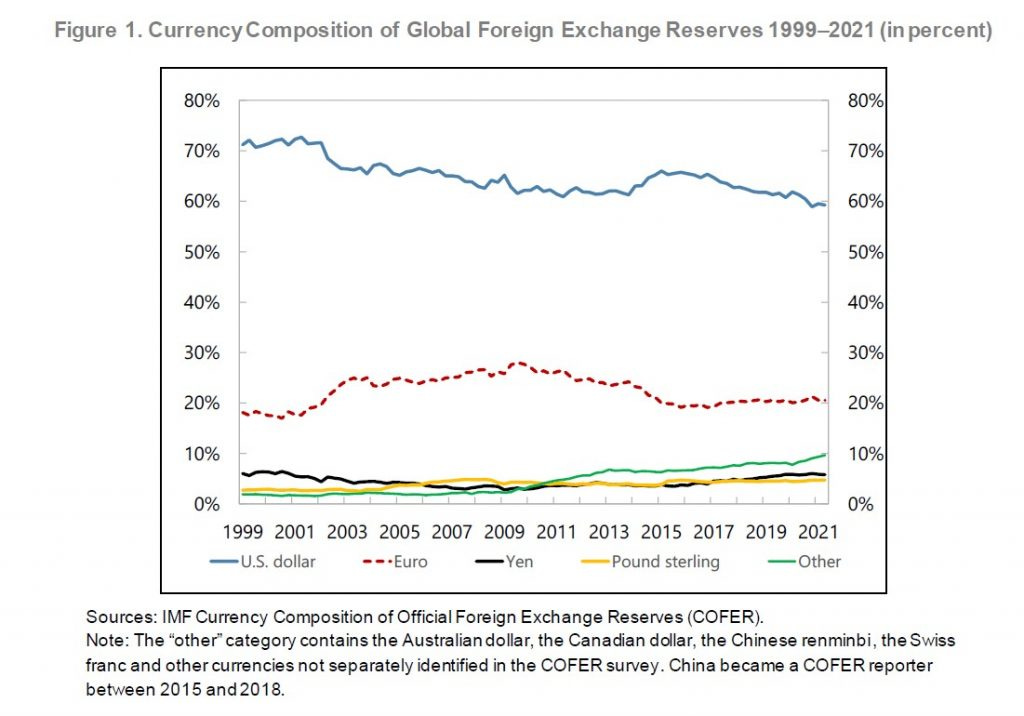

US-dominated institutions like the International Monetary Fund (IMF) have taken note. In 2022, an IMF report warned of the "erosion of dollar dominance", acknowledging that the share of foreign-exchange reserves of central banks around the world held in dollars had shrunk from 70% to 60% in the previous two decades.

This was not a massive decrease, but it is part of a steady trend that is likely to accelerate, as the United States wages a new cold war on China and Russia.

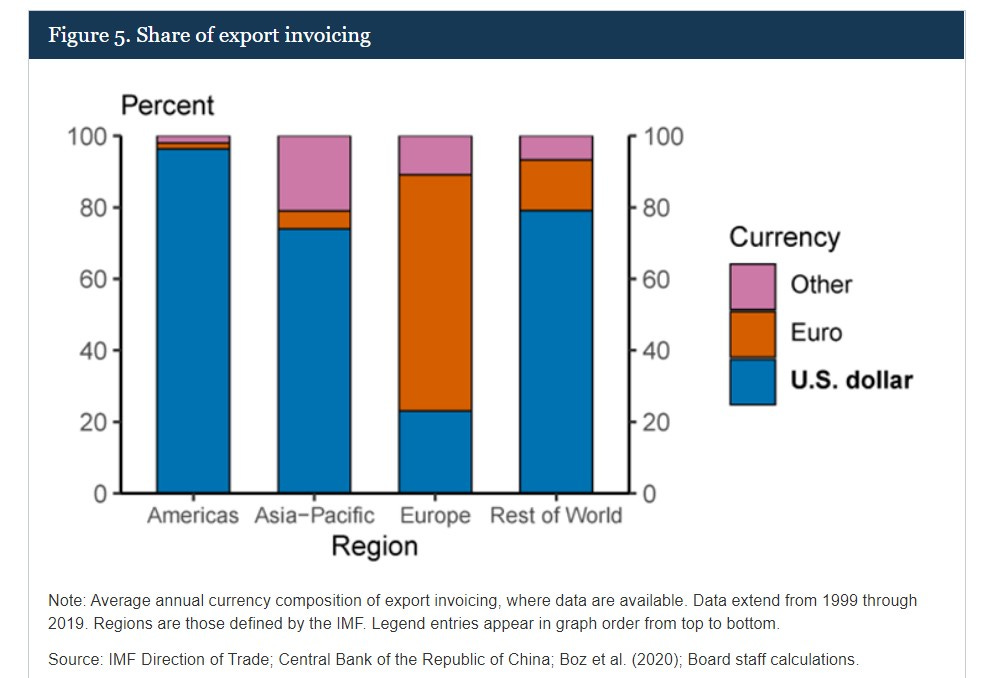

According to the Federal Reserve, the US dollar is involved in roughly 80% of international trade, but this varies greatly depending on the region.

The use of other currencies for trade in Asia is increasing, as countries targeted by unilateral Western sanctions develop new financial mechanisms to trade with their national currencies.

For more than a decade, China has already been using yuan to buy oil from Iran.

After the Donald Trump administration unilaterally sabotaged the Iran nuclear deal, the Joint Comprehensive Plan of Action (JCPOA), back in 2018, Reuters noted that the newly imposed US "sanctions could advance China's 'petro-yuan'”.

The NATO proxy war against Russia in Ukraine was a shot of adrenaline into the arm of de-dollarization. Unprecedented US and EU sanctions led Moscow to develop new financial arrangements with its top trading partners in Asia.

Russia has made importers of its gas pay in rubles, while using local currencies in bilateral trade with countries like India and Iran.

China is also conducting more and more bilateral trade with Russia in yuan.

It took a while, but the call that the People's Bank of China made in 2009 for a new international monetary system is now coming to fruition.

And if Beijing is serious about challenging the hegemony of the US dollar, Saudi Arabia is a key player it needs on its side.

Before the landmark peace deal this March, China had been worried it may have to choose between either Iran or Saudi Arabia. Now, it can maintain good relations with both.

Asian integration accelerates

The normalization of ties between Tehran and Riyadh is a significant development in a larger process of Asian integration. (This is frequently referred to as Eurasian integration, but Europe has essentially politically expelled Russia from the continent over the proxy war in Ukraine, leading Moscow to seek closer ties with its Asian neighbors instead.)

In his 1997 opus "The Grand Chessboard: American Primacy and Its Geostrategic Imperatives", US imperial strategist Zbigniew Brzezinski warned that "the most dangerous scenario" for Washington's unipolar hegemony "would be a grand coalition of China, Russia, and perhaps Iran, an 'antihegemonic' coalition".

US sanctions and aggressive policies toward these three powers have pushed them to unite in exactly the way that Brzezinski feared.

In 2021, China and Iran signed a historic, 25-year economic and strategic partnership agreement estimated at $400 billion. Reporting on the deal, Forbes summarized: "a power shift threatens Western energy".

Iran's President Ebrahim Raisi took an important trip to China in February 2023. It was the first visit by an Iranian president in 20 years.

In a readout on the meeting, Beijing's Foreign Ministry affirmed, "China always views and develops relations with Iran from a strategic perspective, and no matter how the international and regional situation changes, China will remain steadfast in developing friendly cooperation with Iran and advancing China-Iran comprehensive strategic partnership".

Condemning US attacks on Iran, "Xi Jinping emphasized that China supports Iran in safeguarding its sovereignty, independence, territorial integrity and national dignity, supports Iran in resisting unilateralism and bullying, opposes external forces interfering in Iran's internal affairs and undermining its security and stability".

China and Russia are already close allies, with a comprehensive strategic partnership that they say has "no limits". Even with the unprecedented Western sanctions imposed on Moscow in 2022 over the proxy war in Ukraine, China declared that Russia is its "most important strategic partner" and called their friendship "rock solid".

At the same time, Iran and Russia are deepening their integration, especially economically. The two countries are building trade routes to circumvent Western sanctions.

The multibillion-dollar International North–South Transport Corridor (INSTC) will connect India's western Mumbai port to Iran's southern Bandar Abbas port, with goods then traveling north on rail networks, passing through the Caspian Sea, and reaching Russia.

INSTC will not only cut out the need for products to transit through the Mediterranean Sea; it will also nearly halve the transit time of 40 to 60 days on average to instead just 25 to 30 days, while reducing costs by approximately 30%.

China, Russia, and Iran are likewise developing alternatives to the SWIFT inter-bank messaging system, which is dominated by the United States.

As part of the proxy war in Ukraine in 2022, the US and EU disconnected several Russian banks from SWIFT - a scandalous decision that was called the financial "nuclear option".

In response, in January 2023, the central banks of Iran and Russia made an agreement to integrate their inter-bank communication and transfer systems, connecting 52 branches of Iranian banks that use Iran's SEPAM system to 106 banks using Russia's System for Transfer of Financial Messages (SPFS).

Even Riyadh is moving closer to Moscow.

In 2021, Saudi Arabia and Russia signed a military cooperation agreement. Riyadh has also been buying significant military equipment from Moscow.

Russia's ambassador to Saudi Arabia told state media Sputnik in 2023 that Riyadh "is a regular and trusting dialogue at the highest level", adding that the two countries' relations have "a real prospect of reaching the level of strategic partnership".

China's diplomacy could help bring peace and stability to West Asia, after decades of US wars

Despite China's diplomatic breakthrough, clearly, no one expects the Saudi monarchy to become a friend of Iran and to join the anti-imperialist Axis of Resistance.

That said, Riyadh's balancing of relations with Washington and Brussels on one side and Beijing and Moscow on the other reflects the transition toward a multipolar world.

Persian Gulf monarchies that were long loyal clients of the United States have gradually moved toward a more non-aligned foreign policy.

There are certainly profound ideological differences between the Wahhabi and ultra-conservative strains of Sunni Islam sponsored by the Gulf states and the revolutionary Shia liberation theology promoted by Iran.

But Riyadh's normalization of relations with Tehran is a sign that the kingdom's animosity toward the Islamic Republic was much more motivated by geopolitical pressure from the United States than it was religious disagreements.

Washington has sought regime change in Tehran ever since the Iranian people's 1979 revolution overthrew the country's Western-backed dictator. And the US has long seen Saudi Arabia as a key ally, even a proxy, needed to enforce its "maximum pressure campaign" against Iran.

Through decades of illegal unilateral sanctions, constant destabilization operations, and relentless information warfare and propaganda, the United States has desperately tried to make Iran into a pariah state.

China has effectively neutralized this US strategy by brokering peace between West Asia's arch-rivals.

The outrage in Israel reflects the growing realization that Iran has not been isolated. The regime of Benjamin Netanyahu is furious. Tel Aviv sees the peace agreement as a threat, because it thwarts its plans to divide Arabs and Iranians, Sunnis and Shia.

The US has spent years trying to form an alliance between Israel and the Persian Gulf Arab states against Iran. The Donald Trump administration took a victory lap in 2020 with the signing of the so-called Abraham Accords, which were mostly symbolic, but formalized diplomatic relations between the United Arab Emirates, Bahrain, and Israel.

[caption id="attachment_9594" align="aligncenter" width="880"]

US President Donald Trump signing the Abraham Accords normalizing relations between Israel, the UAE, and Bahrain in 2020[/caption]

The fact that the US and Israel see China's peace talks between Iran and Saudi Arabia as a threat demonstrates the fundamental difference between Beijing's and Washington's policies.

China wants stability in the region, to deepen economic integration and trade. In Beijing's readout on the negotiations, top diplomat Wang Yi stressed that "the improvement of relations between Saudi Arabia and Iran has paved the way for realizing peace and stability in the Middle East".

Wang added that "China supports countries in the Middle East in upholding strategic autonomy, strengthening solidarity and cooperation, getting rid of external interference, and really holding the future of the Middle East in their own hands".

This approach could hardly be more different from US foreign policy toward the region, which derives from an obsessive drive to destabilize and control it, to advance the geopolitical objectives of the Wolfowitz Doctrine, to maintain "full-spectrum dominance", to bring about regime change "in seven countries in five years".

Just in the two decades since September 11, 2001, US wars against Iraq, Afghanistan, Libya, Syria, and Yemen killed millions of people, created tens of millions of refugees, and devastated entire countries.

Washington and its allies intentionally stoked sectarianism, giving rise to extremist Salafi-jihadist groups such as al-Qaeda and ISIS.

Countries like Iraq, Syria, and Lebanon in particular suffered heavily from this sectarian conflict.

Now that Saudi Arabia and Iran have normalized relations, these battleground nations serve to benefit the most.

This is a key reason why Iraq spent years trying to broker a deal itself. But the US government, again, intentionally sabotaged Baghdad's peace initiative by murdering Qasem Soleimani in January 2020, when the top Iranian general was negotiating with Saudi Arabia.

Thanks to China's diplomacy, the war in Yemen may also finally come to an end, after nine years.

Saudi Arabia's gruesome bombing campaign, sponsored by the United States and Britain, has killed hundreds of thousands of Yemenis and unleashed the largest humanitarian catastrophe on Earth.

West Asia will undoubtedly be the first region to benefit from the diplomatic breakthrough between Saudi Arabia and Iran. But the geopolitical and economic implications are truly global.

Decades from now, historians will likely look back at this agreement as a watershed moment, reflecting China's new role on the global stage as a negotiator of peace, symbolizing the end of US unipolar hegemony and the rise of a multipolar world.

Three cheers for the emerging New World Order!