China 'counters US dollar hegemony' with gold reserves, Argentina yuan currency swap deal

Advancing global de-dollarization, China’s central bank boosts gold reserves while signing currency swap deals in yuan with countries like Argentina, encouraging use of renminbi instead of US dollars.

China's central bank has taken a series of steps to accelerate the global drive toward de-dollarization, challenging the hegemony of the greenback.

The People's Bank of China is increasing the share of gold in its foreign-exchange reserves, bucking the US dollar, which has for decades been dominant in international central bank holdings.

This January, China also signed an agreement with Argentina's central bank for a currency swap deal, in which Beijing will provide 130 billion Chinese yuan (roughly $19 billion USD) to help Buenos Aires stabilize its currency and economy.

The South American nation said it is "committed to deepen the use of the RMB [renminbi] in the Argentine market for bilateral exchange". (Renminbi is the official name of the Chinese currency, and is often used interchangeably with yuan, which is the unit of account of that currency.)

China's semi-official newspaper Global Times commented that the deal makes it "likely that more Latin American countries will increase the use of Chinese yuan in order to counter the US dollar's hegemony, and strengthen economic ties with China".

These moves show how China is responding to the new cold war that the United States is waging against it.

Concerned that the aggressive sanctions that Washington has already imposed could expand into an all-out economic war, Beijing is decreasing its holdings of dollars in reserves and encouraging the use of its currency in trade with other nations - thereby chipping away at the global reserve currency.

Meanwhile, Russia's central bank has pledged to buy yuan in the foreign-exchange market to hold in its reserves. And Beijing is already purchasing oil from Moscow in its national currency.

China's central bank increases its gold reserves

In December 2022, the People's Bank of China publicly disclosed for the first time in three years that it was increasing the share of gold in its foreign-exchange reserves.

Bloomberg noted at the time that "China’s purchases may be part of a plan to diversify its reserves away from the dollar".

In January 2023, Bloomberg followed up indicating that the People's Bank of China had again boosted its gold reserves.

The media outlet speculated that Russia is filling its reserves with gold as well.

China and Russia are not alone. Bloomberg reported that central banks around the world are buying gold, reaching a record of close to 400 tons in the third fiscal quarter of 2022, compared to 241 tons in the same period in 2018.

Central banks in many countries are increasingly worried that they could be targeted by unilateral Western sanctions.

The United States and European Union have frozen or seized hundreds of billions of dollars and euros from the foreign reserves belonging to the central banks of Russia, Iran, Venezuela, and Afghanistan.

This has pushed many nations to look into diversifying their foreign reserves - not only governments targeted by the West for regime change, but even long-time allies such as Saudi Arabia, Egypt, and Türkiye.

The Financial Times reported in June 2022 that central banks across the planet "are looking towards the renminbi to diversify their foreign currency holdings, in a sign that geopolitical flare-ups could chip away at the dollar’s dominance".

A staggering 85% of central bank reserve managers have expressed interest in investing or already are invested in renminbi, the newspaper noted.

It quoted the head of strategy for global sovereign markets at top Swiss bank UBS, Massimiliano Castelli, who said: "We're seeing a gradual erosion of the dollar... The picture that emerges is one of a multipolar currency system".

The newspaper added, "Four-fifths of the central bankers surveyed said they believed that a move towards a multipolar world — away from a US-centric system — would benefit the renminbi".

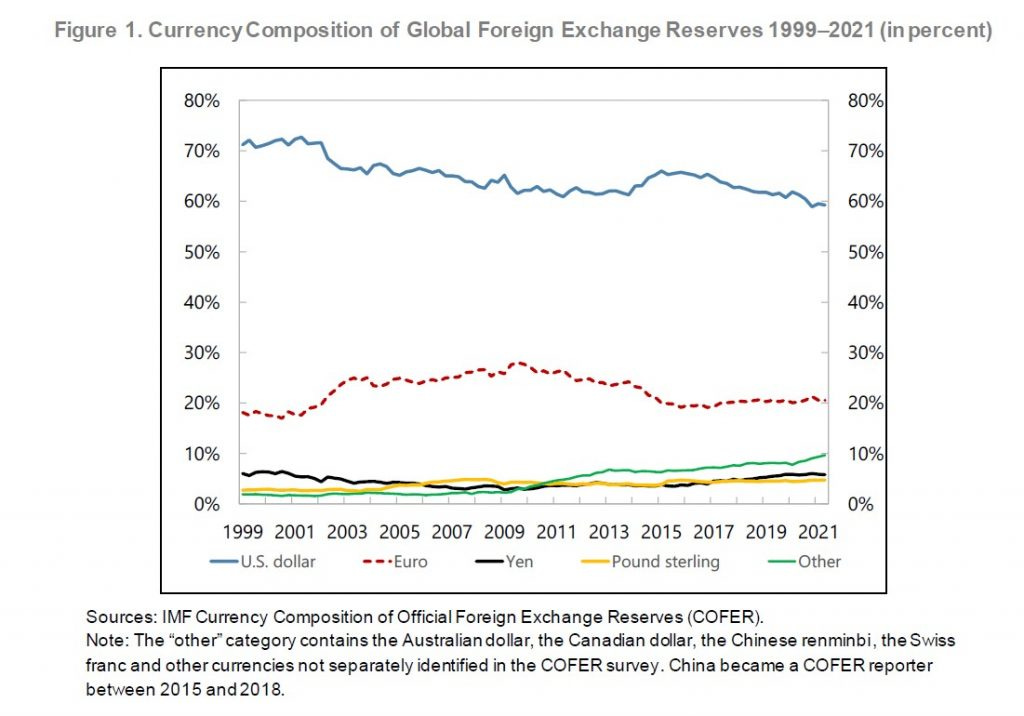

The US-dominated International Monetary Fund (IMF) has made similar warnings. In March 2022, it published a research paper on the "stealth erosion of dollar dominance".

The financial institution observed a marked rise in the use of "nontraditional currencies" in global central bank reserves. The Chinese yuan has driven this increase.

From 2000 to 2021, the percentage of foreign reserves held in US dollars dropped from a bit over 70% to just under 60%.

Thus far, the shift has been slow. But as the United States escalates its new cold war on China, the ensuing geopolitical conflict is likely to accelerate the move toward de-dollarization.

Chinese and Argentine central banks sign yuan currency swap deal

Argentina has struggled for centuries with odious debt owed to colonial and neo-colonial powers.

Today, the South American nation is trapped in $44 billion in dollar-denominated debt with the IMF.

Seeking to fortify its sovereignty and weaken US control, Argentina has strengthened its relations with China and Russia.

China is already Argentina's second-biggest trade partner, after Brazil, and the ties between the countries are growing.

In February 2022, Buenos Aires joined Beijing's massive global infrastructure project, the Belt and Road Initiative.

Argentina has also applied to join the expanded BRICS+ bloc, alongside Brazil, Russia, India, China, and South Africa.

This January 8, the president of Argentina's central bank met with his counterpart from China.

The Argentine central bank reported that the two countries "committed to deepen the use of the RMB [renminbi] in the Argentine market for bilateral exchange".

The swap offers 130 billion in Chinese yuan (roughly $19 billion USD), with an additional "special activation" of 35 billion yuan (approximately $5 billion USD) for interventions in the foreign-exchange market.

Argentine President Alberto Fernández had met with Chinese President Xi Jinping at the G20 summit in November 2022, where they discussed the currency swap.

The Argentine central bank has an account in its own currency, the peso, at the People's Bank of China. China's central bank has an account in yuan at Argentina's central bank. Buenos Aires must pay Beijing back the 130 billion yuan, with interest. But the advantage is that dollars are not involved.

According to the Argentine central bank's most recent report, from November 2022, its total reserves sum to $38 billion USD.

This means that the yuan currency swap represents roughly half of Argentina's reserves. This will have a massive macroeconomic impact.

The newspaper Global Times, which is linked to the Communist Party of China and has a nationalist perspective, explained the thinking of some officials in Beijing, arguing that the currency swap deal "help the Latin American country hedge against shocks brought about by the US' financial policy tightening while promoting its own industrial development".

"It is likely that more Latin American countries will increase the use of Chinese yuan in order to counter the US dollar's hegemony, and strengthen economic ties with China", the semi-official media outlet added.

Argentina is a significant agricultural producer, and its top exports include corn, soy products, and wheat.

Two-thirds of Argentina's exports to China consist of soy beans, with an additional 7% of soy oil. Argentina also exports to China smaller amounts of beef, crude petroleum, and shrimp and prawn.

Most of what China exports to Argentina is various forms of advanced technologies, including phones, TVs, and machines.

Exports, especially from the agricultural sector, are one of the only ways Argentina can get access to foreign currencies - or more specifically dollars, which it needs to service its dollar-denominated debt with the IMF.

Normally, if a company in a country like Argentina needs dollars, or if a bank needs foreign currency for a loan, these firms would buy it on the foreign-exchange market. In contrast, swap lines cut out the middleman and create direct relationships between the central banks of countries.

The Chinese swap line deal could help Argentina hold on to dollars to service its debt, while using yuan to buy products from China.

Perhaps even more importantly for Buenos Aires, which suffers with high rates of inflation, it could also use yuan instead of dollars to stabilize the ever-weakening Argentine peso by intervening in the foreign-exchange market.

China uses currency swap lines to help debt-burdened countries, while advancing de-dollarization

China began conducted currency swaps with Argentina back in 2009, under left-wing President Cristina Fernández de Kirchner. Deals have been repeatedly renewed since then.

But the South American nation is not the only country that has worked out a system like this with the East Asian giant.

In December, the Wall Street Journal reported that Beijing's central bank is using an "unusual channel": "currency-swap lines to support governments that borrowed heavily from Chinese banks".

The People's Bank of China (PBOC) has given hundreds of billions of dollars worth of yuan to dozens of countries in exchange for their domestic currencies, the newspaper reported.

Among these recipients are Pakistan, Sri Lanka, Argentina, and Laos -- all nations that struggle with external debt, much of it denominated in US dollars.

The Wall Street Journal explained, "By replenishing other countries’ reserves, the PBOC may be helping some of the world’s most indebted countries avoid rising borrowing costs".

While the newspaper portrayed this as a cynical effort by China to "prop up" members of its Belt and Road Initiative, the media outlet acknowledged that Beijing is also using the currency swaps to accelerate the de-dollarization of the international financial system.

"The PBOC says the swap lines are there to help grease the wheels of international trade, ensure financial stability and further the adoption of the yuan in a world where trade and finance are dominated by the U.S. dollar", the Wall Street Journal wrote.

It added: "The PBOC’s swap network is the largest of its kind, according to the World Bank. The PBOC said in a 2021 report that it has swap facilities with 40 countries with a combined capacity of almost 4 trillion yuan, or about $570 billion".

Argentina and Brazil deepen economic integration, with eyes on new Latin American currency

While Buenos Aires is collaborating more closely with Beijing (its second-largest trading partner), Argentina has simultaneously pushed for stronger ties with Brazil (its largest trading partner) and economic integration of Latin America.

Brazil's left-wing President Lula da Silva returned to power on January 1.

Two days later, Argentina's Ambassador Daniel Scioli met with Brazil's Economic Minister Fernando Haddad.

Scioli said his government's top priority was "the agreement on deep Argentina-Brazil integration" that the countries' Presidents Alberto Fernández and Lula da Silva are due to sign at the summit of the Community of Latin American and Caribbean States (CELAC) in Buenos Aires on January 24.

The Argentine ambassador likewise revealed that his government is in talks with the state-owned Brazilian Development Bank to receive financing to advance construction of a pipeline, named after former President Néstor Kirchner, which will provide a steady supply of gas to Brazil.

Argentina has the world's second-biggest reserves of shale gas and the forth-biggest of shale oil.

Scioli added that Argentina and Brazil look to increase their exports and trade with each other, "conserving the reserves of both countries in the framework of the system of local currencies".

Scioli's hint that Argentine-Brazilian trade will be done with local currencies led to international speculation that the countries are moving forward with Lula's proposed plan to create a sovereign Latin American currency for regional trade.

This frightened some foreign investors, and was reported in the financial press with a heavy dose of concern - and condescension.

Haddad downplayed the reports, saying, "There is no proposal for one currency for Mercosur". But his words were careful: The Brazilian economic minister said there was not yet a proposal; he didn't deny that the potential currency was discussed.

It was likely that Haddad was merely trying to reassure foreign investors.

In his inauguration speech, Lula pledged more robust social spending to fight poverty and hunger and vowed to reverse the privatizations carried out by previous far-right President Jair Bolsonaro.

These policies are overwhelmingly popular among the Brazilian people, but they scared some investors in Brazilian stocks, who sold off shares, leading to market instability and a slight drop in the value of the country's currency, the real, against the dollar.

In the mean time, Brazil's new government, like that of Argentina, has vowed to deepen its alliance with China.

On the day after his inauguration, Lula met with China's Vice President Wang Qishan. The statesman gave the Brazilian leader a letter from President Xi Jinping, which called to boost Chinese-Brazilian ties.

Lula tweeted, "China is our biggest trading partner, and we can even further expand the relations between our countries".

Great evil is always followed by great good - and this is the best news yet ! Maybe this will force the USA to think again about squandering $900 billion on its annual global "offence" budget. And starved of this oxygen NATO can be asphyxiated and left to wither and die . And Zelensky should have all his ill-gotten assets confiscated, to be re-invested in dealing with US domestic problems. And they should return the money they have stolen from Afghanistan - this is yet another nail in the coffin of US hegemony and the funeral is long overdue. Arise EURASIA, BRICS and the Global South !

At the risk of repeating myself, the Empire of Chaos will fight to the death of us all to defend the indefensible, US dollar hegemony.

The USA is already on the cusp of collapse. The end of US dollar hegemony will be the last nail in the coffin. With luck and diplomacy from Moscow and Beijing we might just survive the collapse of what Pepe Escobar rightly titled "The Empire of Chaos".

Good luck everyone.