BRICS challenges US 'dollar dominance', Saudi considers selling oil in other currencies: New multipolar economic order

BRICS is “developing a fairer system of monetary exchange” to challenge the “dominance of the dollar”, South Africa revealed. Saudi Arabia is considering selling oil in other currencies.

The international economic system had been dominated for decades by the United States, but this financial architecture is rapidly fracturing with the creation of new institutions in the Global South.

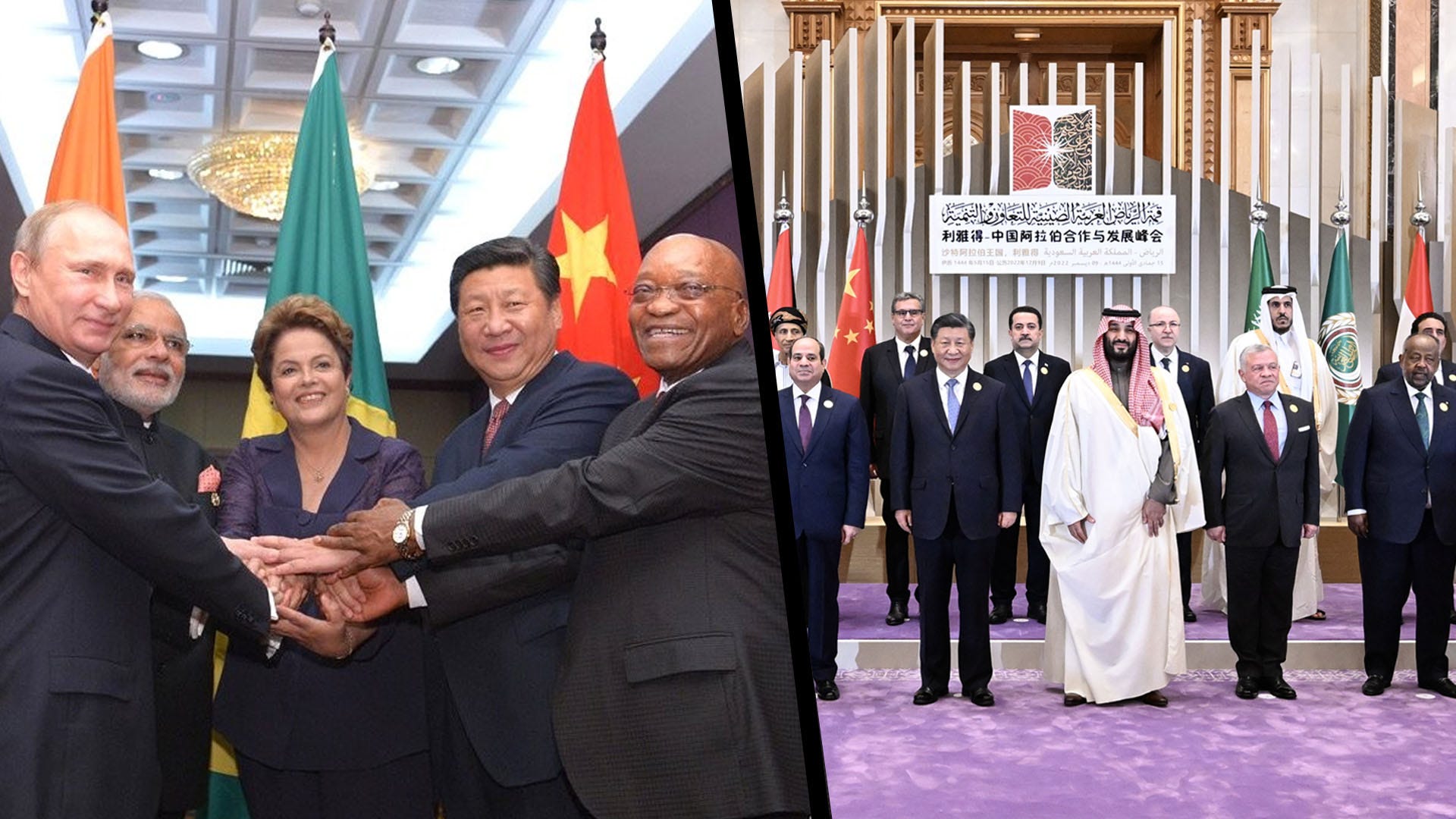

The BRICS bloc of Brazil, Russia, India, China, and South Africa is working "to develop a fairer system of monetary exchange", to challenge the "dominance of the dollar", South Africa's foreign minister has revealed.

Saudi Arabia publicly confirmed that it is considering selling its oil in other currencies.

China's President Xi Jinping said Beijing will buy energy from the Persian Gulf states in its own currency, the renminbi.

Prominent economist Zoltan Pozsar, of the Swiss investment bank Credit Suisse, has observed that the "unipolar era" of US hegemony is quickly being replaced with a new "multipolar" order of "one world, two systems".

"China is proactively writing a fresh set of rules" and "creating a new type of globalisation", Pozsar wrote, describing how this transition threatens "the 'exorbitant privilege' that the dollar holds as the international reserve currency".

BRICS works to 'develop a fairer system of monetary exchange' as alternative to 'dominance of the dollar'

South Africa's Foreign Minister Naledi Pandor told Russia's state media outlet Sputnik that the BRICS bloc is working to "develop a fairer system of monetary exchange", to weaken the "dominance of the dollar".

Pandor's comments were ignored by Western media outlets, but widely reported in the Indian press.

"We have always been concerned by the fact that there is a dominance of the dollar and that we do need to look at alternative [systems]", she said.

"The systems currently in place tend to privilege very wealthy countries and tend to be really a challenge for countries, such as ourselves, which have to make payments in dollars, which costs much more in terms of our various currencies", Pandor continued.

"So I do think a fairer system has to be developed, and it's something we're discussing with the BRICS ministers in the economic sector discussions", the South African foreign minister added.

In 2014, the BRICS countries created the New Development Bank (NDB) as an alternative to the US-dominated World Bank.

Pandor explained, "Within the economic context we are looking at how the NDB and other institutional formations may assist us to develop a fairer system of monetary exchange".

The South African foreign minister also criticized the United States' imposition of unilateral sanctions, which are illegal under international law.

She told Sputnik, "We always have a problem with unilateral sanctions and their impact on many countries that fall outside a particular conflict, so we have indicated to our friends in the United States that we really want them to relook at this imposition of unilateral sanctions, which is often not very helpful a strategy in resolving problems".

Saudi Arabia considers selling oil in other currencies

While the BRICS is gradually moving toward de-dollarization, one of Washington's most important historical allies is doing the same.

The world's largest oil exporter, Saudi Arabia, has publicly acknowledged that it is considering selling its crude in other currencies, not just the US dollar.

Saudi Finance Minister Mohammed Al-Jadaan told Bloomberg TV, "There are no issues with discussing how we settle our trade arrangements, whether it is in the US dollar, whether it is the euro, whether it is the Saudi riyal".

"I don't think we are waving away or ruling out any discussion that will help improve the trade around the world", he said.

In 1974, Saudi Arabia agreed to sell its crude in the dollar and invest its oil revenue in Treasury securities, in return for US government protection.

This petrodollar system helped undergird the status of the greenback as the global reserve currency, after US President Richard Nixon ended the convertibility of the dollar to gold in 1971.

But the petrodollar now has direct challengers.

The Wall Street Journal reported in March 2022 that "Saudi Arabia [was] in active talks with Beijing to price some of its oil sales to China in yuan". Riyadh did not publicly confirm this at the time.

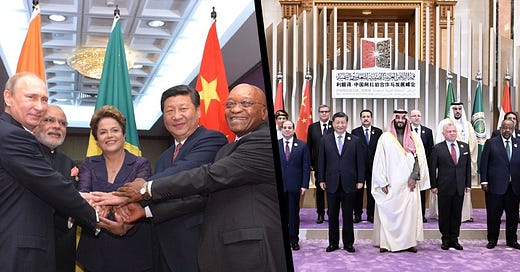

Chinese President Xi Jinping then visited Riyadh in December, where he held a historic meeting with the Gulf Cooperation Council (GCC) and the 21 member states of the Arab League.

Xi said he and top officials from Saudi Arabia, the UAE, Qatar, Kuwait, Bahrain, and Oman discussed purchasing Persian Gulf energy with China's own currency, the renminbi.

The Chinese president explained, in comments reported by Reuters: "China will continue to import large quantities of crude oil from GCC countries, expand imports of liquefied natural gas, strengthen cooperation in upstream oil and gas development, engineering services, storage, transportation and refining, and make full use of the Shanghai Petroleum and Natural Gas Exchange as a platform to carry out yuan settlement of oil and gas trade".

China is already Saudi Arabia's top trading partner, and Beijing, Riyadh, and the GCC pledged to deepen their multilateral trade.

Prominent Credit Suisse economist describes new multipolar order challenging US dollar's 'exorbitant privilege'

These historic developments in the BRICS and Saudi Arabia are part of an international shift to a multipolar economic order.

Prominent economist Zoltan Pozsar, global head of short-term interest rate strategy at Swiss investment bank Credit Suisse, described this transition in a January 20 op-ed in the Financial Times, titled "Great power conflict puts the dollar’s exorbitant privilege under threat".

Pozsar, who is something of a celebrity in contemporary economics and has been described as a "superstar" by the financial press, wrote that the "unipolar era" following the end of the first cold war, in which "the US was the undisputed hegemon", is now coming to an end.

In this increasingly multipolar world, "China is proactively writing a fresh set of rules", he said, "creating a new type of globalisation through institutions such as the Belt and Road Initiative, the Brics+ group of emerging economies and the Shanghai Cooperation Organisation".

We are seeing a bifurcation of global economic and political institutions, in what "may eventually lead to 'one world, two systems'", Pozsar explained, referencing China's model for Hong Kong of "one country, two systems".

He wrote that the "dollar-based monetary order is already being challenged in multiple ways", in particular by "the spread of de-dollarisation efforts and central bank digital currencies (CBDCs)".

"Recently, the pace of de-dollarisation appears to have picked up", he observed.

Pozsar pointed out:

China and India have been paying for Russian commodities in renminbi, rupees and UAE dirhams. India has launched a rupee settlement mechanism for its international transaction while China asked GCC countries to make full use of the Shanghai Petroleum and Natural Gas Exchange for the renminbi settlement of oil and gas trades over the next three to five years. With the expansion of Brics to beyond Brazil, Russia, India and China, the de-dollarisation of trade flows may proliferate.

Major countries like China, Russia, and Saudi Arabia are exporting more than ever, which means they have record current account surpluses, Pozsar noted. But their central banks are not buying US Treasury securities; instead they are investing in gold, commodities, and projects like the Belt and Road Initiative.

"If less trade is invoiced in US dollars and there is a dwindling recycling of dollar surpluses into traditional reserve assets such as Treasuries, the 'exorbitant privilege' that the dollar holds as the international reserve currency could be under assault", the Credit Suisse economist concluded.

The US Debt Clock (https://usdebtclock.org) is an interesting site.

It'd be great if somebody made an equivalent for Global Currency, Assets, Capital Flow. It would track current dollar flows in and out of the US, China, etc, assets, securities, gold, other currency capital exchanges...

In short, we need a map of dedollarization and the international economic reality. It's VERY difficult to get a handle on this sort of thing otherwise unless one's prepared to pour over hundreds of datasets, many difficult for us regular folks to access.